In an attempt to conceal a theft of funds, Snake N. Grass, controller of Bucolic Products, Inc.,

Question:

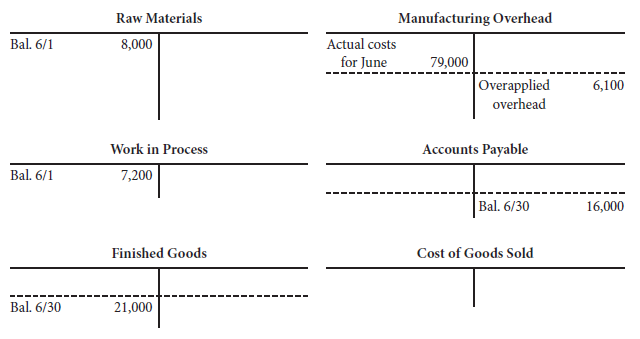

In an attempt to conceal a theft of funds, Snake N. Grass, controller of Bucolic Products, Inc., placed a bomb in the company?s record vault. The ensuing explosion left only fragments of the company?s factory ledger, as shown below:

To bring Mr. Grass to justice, the company must reconstruct its activities for June. Your team has been assigned to perform the task of reconstruction. After interviewing selected employees and sifting through charred fragments, you have determined the following additional information:

a. According to the company?s treasurer, the accounts payable are for purchases of raw materials only. The company?s balance sheet, dated May 31, shows that accounts payable had a $20,000 balance at the beginning of June. The company?s bank has provided photocopies of all cheques that cleared the bank during June. These photocopies show that payments to suppliers during June totalled $119,000. (All materials used during the month were direct materials.)

b. The production superintendent states that manufacturing overhead cost is applied to jobs on the basis of direct labour-hours. However, he does not remember the rate currently being used by the company.

c. Cost sheets kept in the production superintendent?s office show that only one job was in process on June 30, at the time of the explosion. The job had been charged with $6,600 in materials, and 500 direct labour-hours at $11 per hour had been worked on the job.

d. A log is kept in the finished goods warehouse showing all goods transferred in from the factory. This log shows that the cost of goods transferred into the finished goods warehouse from the factory during June totalled $313,000.

e. The company?s May 31 balance sheet indicates that the finished goods inventory totalled $36,000 at the beginning of June.

f. A charred piece of the payroll ledger, found after sifting through piles of smoking debris, indicates that 11,500 direct labour-hours were recorded for June. The company?s human resources department has verified that, as a result of a union contract, all factory employees earn the same $11 per hour rate.

g. The production superintendent states that there was no under- or overapplied overhead in the manufacturing overhead account at May 31.

Required:

1. Each member of the team should determine what types of transactions would be posted to one of the following sets of accounts:

a. Raw materials and accounts payable.

b. Work in process and manufacturing overhead.

c. Finished goods and cost of goods sold.

Each team member should present a summary of the types of transactions that would be posted to the accounts to the other team members, who should confirm or correct the summary. Then, the team should work together to complete steps 2 through 8.

2. Determine the transaction that should be reflected in the manufacturing overhead account, and then determine the company?s predetermined overhead rate.

3. Determine the June 30 balance in the company?s work-in-process account.

4. Determine the transactions that should be reflected in the work-in-process account.

5. Determine the transactions that should be reflected in the finished goods account.

6. Determine the transactions that should be reflected in the cost of goods sold account.

7. Determine the transactions that should be reflected in the accounts payable account.

8. Determine the transactions that should be reflected in the raw materials account.

A good method for determining the transactions that were recorded in a given account is to update the related, fragmented T-account by posting whatever entries can be developed from the information provided above.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259103261

4th Canadian edition

Authors: Peter C. Brewer, Ray H Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan