Landover Amusement Park is considering the construction of a new facility to house a curved, multistory movie

Question:

Landover Amusement Park is considering the construction of a new facility to house a curved, multistory movie screen.

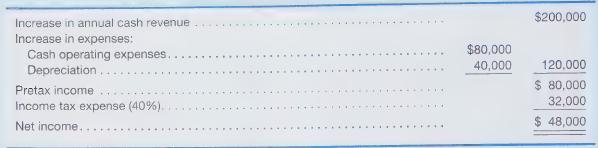

The facility will cost \($400,000\) and be useful for 10 years, with no salvage value. The facility will be depreciated on a straight-line basis over 10 years on both the books and the tax return. The following annual results are expected if the facility is constructed:

Landover uses a 12% cutoff rate when analyzing capital expenditure proposals using net present value.

Required

a. What are the annual net cash flows (net inflows) from this project?

b. Compute the cash payback period.

c. Compute the average rate of return.

d. Compute the net present value and indicate whether it is positive or negative.

e. Assume that Landover decides to use a 10% cutoff rate when using net present value analysis. Compute the net present value using a 10% cutoff rate and indicate whether it is positive or negative.

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.