Marlon Plastics purchased a new machine one year ago at a cost of $750,000. Although the machine

Question:

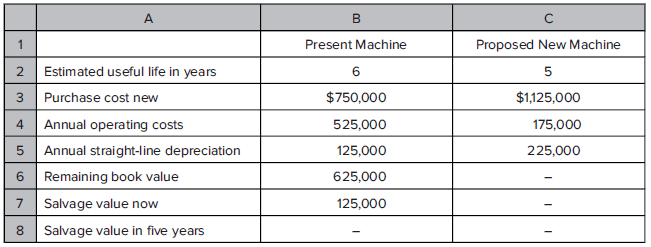

Marlon Plastics purchased a new machine one year ago at a cost of $750,000. Although the machine operates well, the president of the company is considering replacing it with a new electronic machine that has just entered the market. The new machine would slash the annual operating costs by two-thirds, as shown in the data provided below:

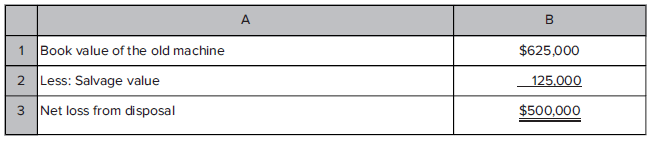

The president?s assistant prepared the following analysis:

?Even though the new machine looks good,? said the president, ?we can?t get rid of that old machine if it means taking a huge loss on it. We?ll have to use that old machine for at least a few more years.? Sales are expected to be $2.5 million per year, and selling and administrative expenses are expected to be $1,575,000 per year, regardless of which machine is used.

Required:

1. Prepare a summary income statement covering the next five years, assuming that

a. The new machine is not purchased.

b. The new machine is purchased.

2. Using three capital investment analysis methods, determine whether the company should purchase the new equipment. Use only the incremental costs in your analysis. The company likes a 16% return on all its investments. What is the profitability index of this investment?

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan