Perdon Corporation manufactures safelarge mobile safes and large walk-in stationary bank safes. As part of its annual

Question:

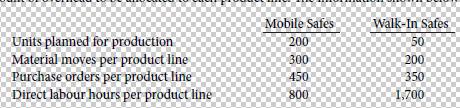

Perdon Corporation manufactures safe—large mobile safes and large walk-in stationary bank safes. As part of its annual budgeting process, Perdon is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be allocated to each product line. The information shown below relates to overhead.

Instructions

(a) The total estimated manufacturing overhead was $260,000. Under traditional costing (which assigns overhead on the basis of direct labour hours), what amount of manufacturing overhead costs are assigned to:

1. One mobile safe?

2. One walk-in safe?

(b) The total estimated manufacturing overhead of $260,000 was composed of $160,000 for material handling costs and $100,000 for purchasing activity costs. Under activity-based costing (ABC):

1. What amount of material handling costs are assigned to:

a. One mobile safe?

b. One walk-in safe?

2. What amount of purchasing activity costs are assigned to:

a. One mobile safe?

b. One walk-in safe?

(c) Compare the amount of overhead allocated to one mobile safe and to one walk-in safe under the traditional costing approach versus under ABC.

Step by Step Answer:

Managerial Accounting Tools for Business Decision Making

ISBN: 978-1118856994

4th Canadian edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly