Refer to E5-47B and E5-48B. Assume the Landon Dairy Forming Department has the following costs per equivalent

Question:

Refer to E5-47B and E5-48B. Assume the Landon Dairy Forming Department has the following costs per equivalent unit (EU) on its own production cost report for the month of January:

Cost per EU transferred in from Churning Department

Cost per Direct Materials EU = \($0.10\) Cost per Conversion Costs EU = \($0.15\)

Requirements:

1. What is the total cost, from start to finish, of producing one pound of butter during January?

2. If the company sells all 400,000 pounds of the butter made in January, at a selling price of \($5.50\) per pound, what is the total gross profit for the month?

Data From E5-48B:-

Refer to the Churning Department information for Landon Dairy in E5-47B.

Requirements 1. What journal entry(s) would have been made during the month to record manufacturing costs? (Use Wages Payable as the credit for the direct labor costs.)

2. What journal entry is needed at the end of the month to transfer the cost of the butter out of the Churning Department and into the next department, the Forming Department?

3. Post the journal entries to the Work in Process Inventory–Churning Department T-account.

Data From E5-47B:-

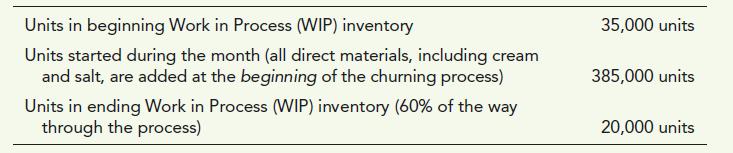

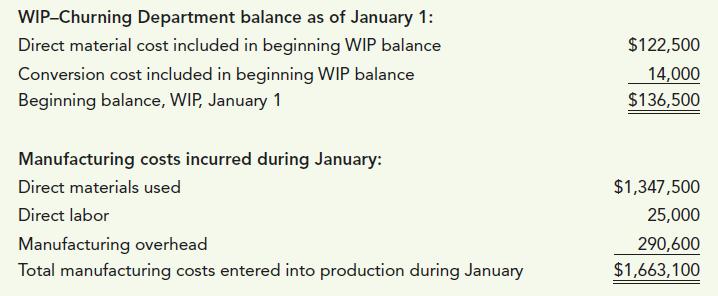

Landon Dairy produces an organic butter that is sold by the pound. The production of the butter begins in the Churning Department.

Data for the Churning Department for January follows:

Cost information is as follows:

Requirements:

1. Prepare a production cost report for January for the Churning Department.

2. How much did it cost to make one pound of butter in the Churning Department?

3. How much did it cost to make a partially completed pound of butter in the Churning Department? Does this make sense? Why or why not?

Step by Step Answer: