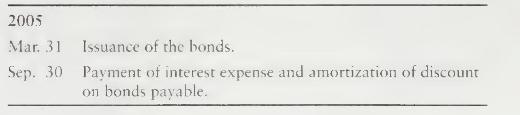

Refer to the bond situation of Hewitt Corporation in Exercise 15-27. Hewitt issued the bonds at the

Question:

Refer to the bond situation of Hewitt Corporation in Exercise 15-27. Hewitt issued the bonds at the advertised price. The company uses the straight-line amortization method and reports financial statements on a calendar-year basis.

Requirements

1. Journalize the following bond transactions of Hewitt Corporation. Explanations are not required.

2. What is Hewitt's carrying amount of the bonds payable at

a. September 30,2005 ?

b. March 31,2006 ?

Exercise 15-27

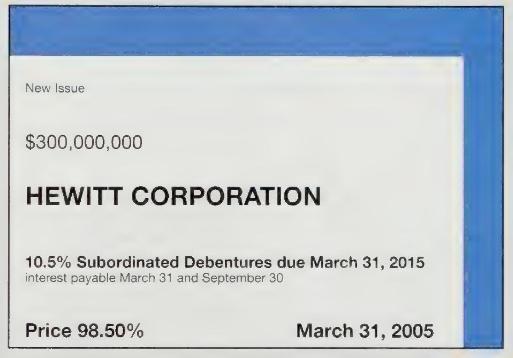

This (partial and adapted) advertisement appeared in The Wall Street Journal.

A subordinated debenture gives rights to the bondholder that are more restricted than the rights of other bondholders.

Requirements

Answer these questions about Hewitt Corporation's debenture bonds payable:

1. Hewitt issued these bonds payable at their offering price on March 31, 2005. Describe the transaction in detail, indicating who received cash, who paid cash, and how much.

2. Why is the stated interest rate on these bonds so high?

3. Compute Hewitt's annual cash interest payment on the bonds.

4. Compute Hewitt's annual interest expense under the straight-line amortization method.

Step by Step Answer: