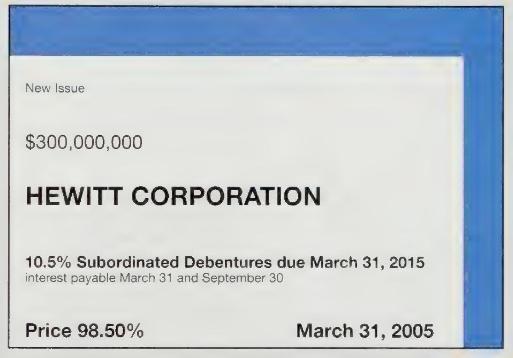

Question: This (partial and adapted) advertisement appeared in The Wall Street Journal. A subordinated debenture gives rights to the bondholder that are more restricted than the

This (partial and adapted) advertisement appeared in The Wall Street Journal.

A subordinated debenture gives rights to the bondholder that are more restricted than the rights of other bondholders.

Requirements

Answer these questions about Hewitt Corporation's debenture bonds payable:

1. Hewitt issued these bonds payable at their offering price on March 31, 2005. Describe the transaction in detail, indicating who received cash, who paid cash, and how much.

2. Why is the stated interest rate on these bonds so high?

3. Compute Hewitt's annual cash interest payment on the bonds.

4. Compute Hewitt's annual interest expense under the straight-line amortization method.

New Issue $300,000,000 HEWITT CORPORATION 10.5% Subordinated Debentures due March 31, 2015 interest payable March 31 and September 30 Price 98.50% March 31, 2005

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts