Question:

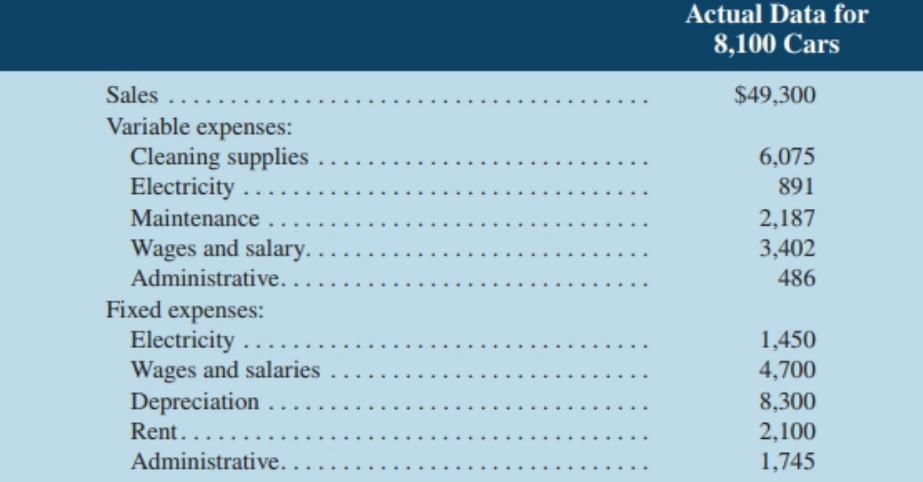

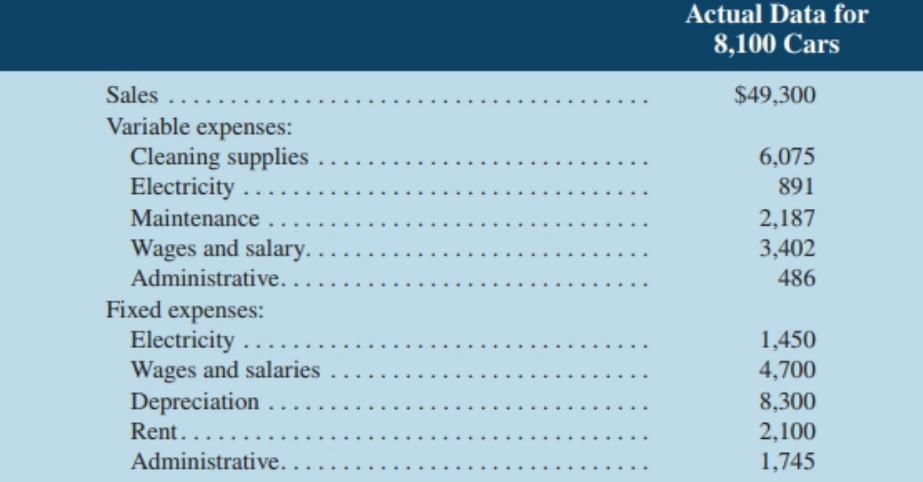

Refer to the data in Exercise 9-8. Auto Lavage's actual level of activity was 8,100 cars. The actual revenues and expenses for October are given below

Required

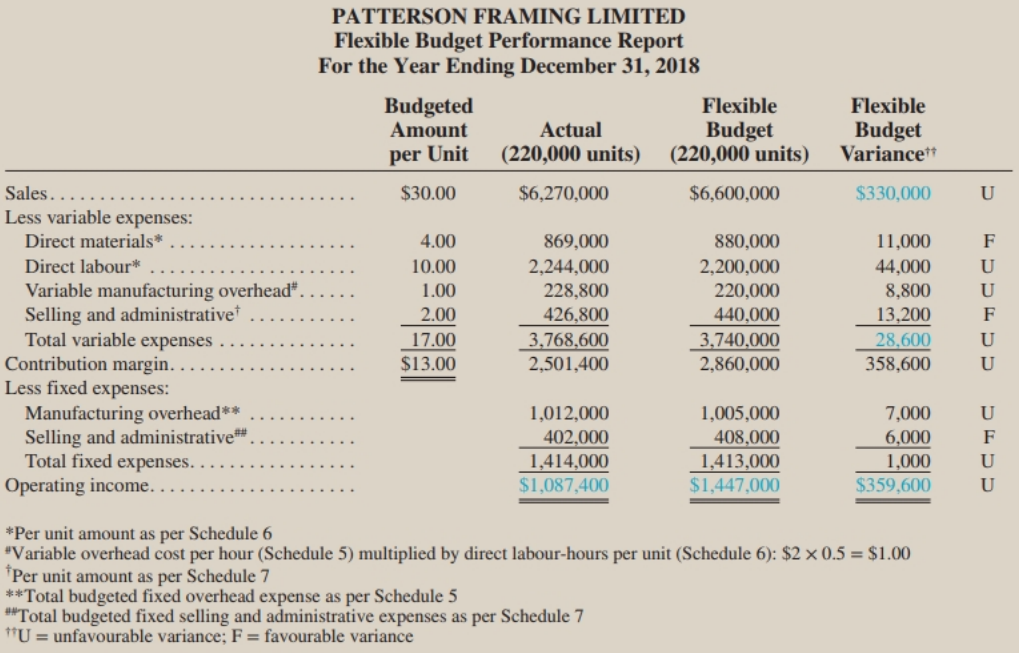

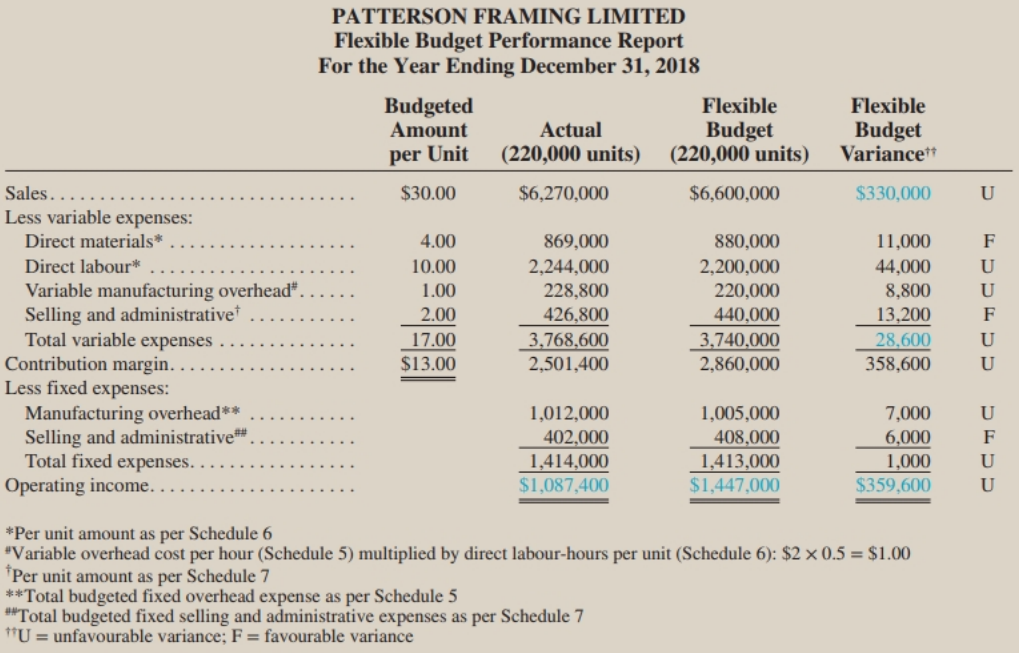

1. Prepare a flexible budget performance report for October using Exhibit 9-4 as your guide.

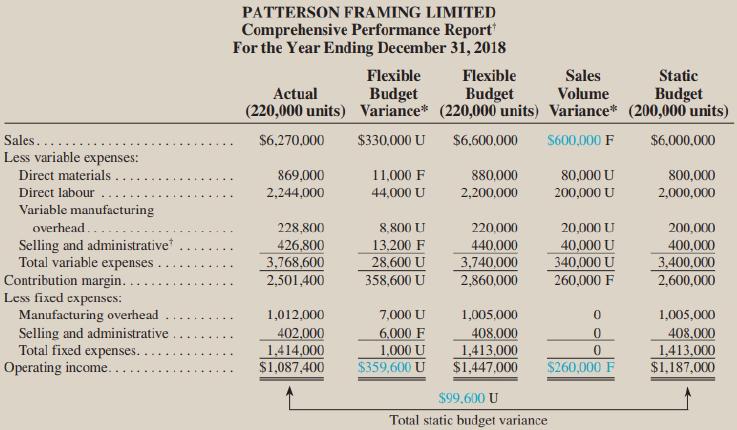

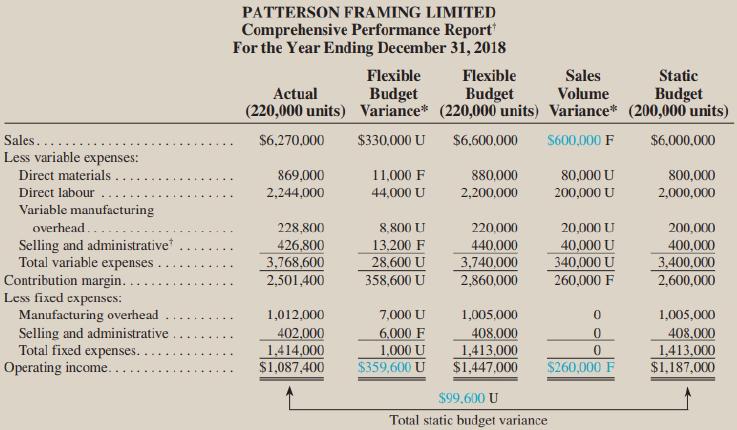

2. Prepare a comprehensive performance report for October using Exhibit 9-6 as your guide. Assume that the static budget for October was based on an activity level of 8,000 cars.

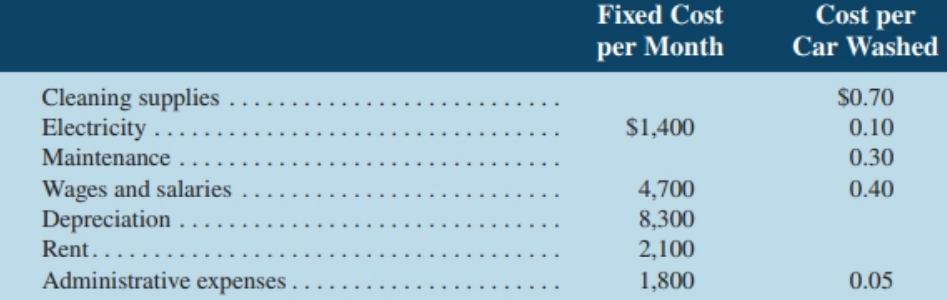

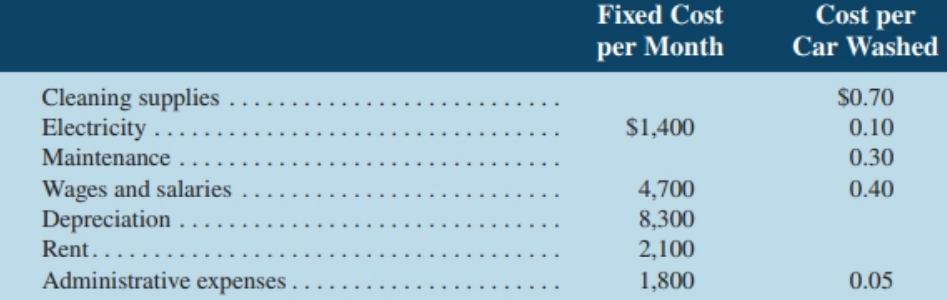

Data from Exercise 9-8

Auto Lavage is a Canadian company that owns and operates a large automatic car wash facility near Quebec. The following table provides data concerning the company's costs:

The company expects to charge customers an average of $5.90 per car washed.

Exhibit 9-4

Exhibit 9-6

Transcribed Image Text:

Actual Data for 8,100 Cars $49,300 Sales ... Variable expenses: Cleaning supplies Electricity . 6,075 891 Maintenance 2,187 3,402 Wages and salary. Administrative. 486 Fixed expenses: Electricity . Wages and salaries Depreciation Rent..... 1,450 4,700 8,300 2,100 ..... Administrative... 1,745 PATTERSON FRAMING LIMITED Flexible Budget Performance Report For the Year Ending December 31, 2018 Flexible Budget Variance* Flexible Budgeted Amount Actual Budget (220,000 units) per Unit (220,000 units) Sales. $30.00 $6,270,000 $6,600,000 $330,000 Less variable expenses: Direct materials* 4.00 869,000 880,000 11,000 44,000 8,800 13,200 Direct labour* 10.00 2,244,000 228,800 426,800 2,200,000 220,000 440,000 Variable manufacturing overhead" . Selling and administrativet Total variable expenses Contribution margin. Less fixed expenses: Manufacturing overhead** Selling and administrative# Total fixed expenses. Operating income. 1.00 2.00 3,768,600 2,501,400 28,600 358,600 17.00 3,740,000 2,860,000 $13.00 1,012,000 402,000 1,414,000 $1,087,400 1,005,000 408,000 1,413,000 $1,447,000 7,000 6,000 1,000 $359,600 *Per unit amount as per Schedule 6 "Variable overhead cost per hour (Schedule 5) multiplied by direct labour-hours per unit (Schedule 6): $2 × 0.5 = $1.00 *Per unit amount as per Schedule 7 **Total budgeted fixed overhead expense as per Schedule 5 **Total budgeted fixed selling and administrative expenses as per Schedule 7 "U = unfavourable variance; F= favourable variance