Swanson Corporation is evaluating five different capital expenditure proposals. The companys cutoff rate for net present value

Question:

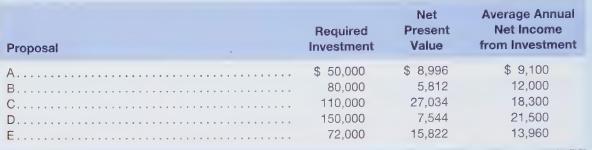

Swanson Corporation is evaluating five different capital expenditure proposals. The company’s cutoff rate for net present value analysis is 12%. A 15% salvage value is expected from each of the investments. Information on the five proposals is as follows:

Required

a. Compute the excess present value index for each of the five proposals.

b. Compute the average rate of return for each of the five proposals.

c. Assume that Swanson will commit no more than \($200,000\) to new capital expenditure proposals. Using the excess present value index, which proposals would be accepted? Using the average rate of return, which proposals would be accepted?

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.