Sylvan Company uses activity-based costing to determine product costs for external financial reports. Some of the entries

Question:

Sylvan Company uses activity-based costing to determine product costs for external financial reports. Some of the entries have been completed to the manufacturing overhead account for the current year, as shown by entry (a) below:

Required:

1. What does entry (a) represent?

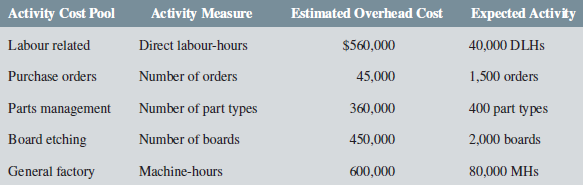

2. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools:

Compute the activity rate (i.e., predetermined overhead rate) for each of the activity cost pools.

3. During the year, actual activity was recorded as follows:Activity Cost Pool ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?Actual ActivityLabour related...........................................................41,000 DLHsPurchase orders........................................................1,300 ordersParts management...................................................420 part typesBoard etching............................................................2,150 boardsGeneral factory.........................................................82,000 MHs

Determine the amount of manufacturing overhead cost applied to production for the year.

4. Determine the amount of underapplied or overapplied overhead cost for the year.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan