The May 31 bank statement of Multi-Plex Healthcare has just arrived from First State Bank. To prepare

Question:

The May 31 bank statement of Multi-Plex Healthcare has just arrived from First State Bank. To prepare the bank reconciliation, you gather the following data.

a. The May 31 bank balance is \(\$ 12,209\).

b. The bank statement includes two charges for NSF checks from customers. One is for \(\$ 67\), and the other for \(\$ 195\).

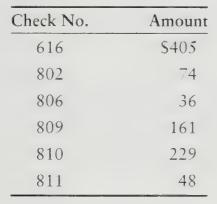

c. The following Multi-Plex checks are outstanding at May 31:

d. Multi-Plex collects from a few customers by EFT. The May bank statement lists a \(\$ 200\) EFT deposit for a collection on account.

e. The bank statement includes two special deposits that Multi-Plex hasn't recorded yet: \(\$ 900\), for dividend revenue, and \(S 16\), the interest revenue Multi-Plex earned on its bank balance during May.

f. The bank statement lists a \(\$^{7}\) subtraction for the bank service charge.

g. On May 31, the Multi-Plex treasurer deposited \$381, but this deposit does not appear on the bank statement.

h. The bank statement includes a \(\$ 410\) deduction for a check drawn by Multi-State Freight Company. Multi-Plex notified the bank of this bank error.

i. Multi-Plex's Cash account shows a balance of \(\$ 11,200\) on May 31.

Requirements

1. Prepare the bank reconciliation for Multi-Plex Healthcare at May 31.

2. Record the entries called for by the reconciliation. Include an explanation for each entry.

Step by Step Answer: