Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is the present value (PV) of an offer of $15,000 two years from now if the Opportunity Cost of Capital (OCC) is

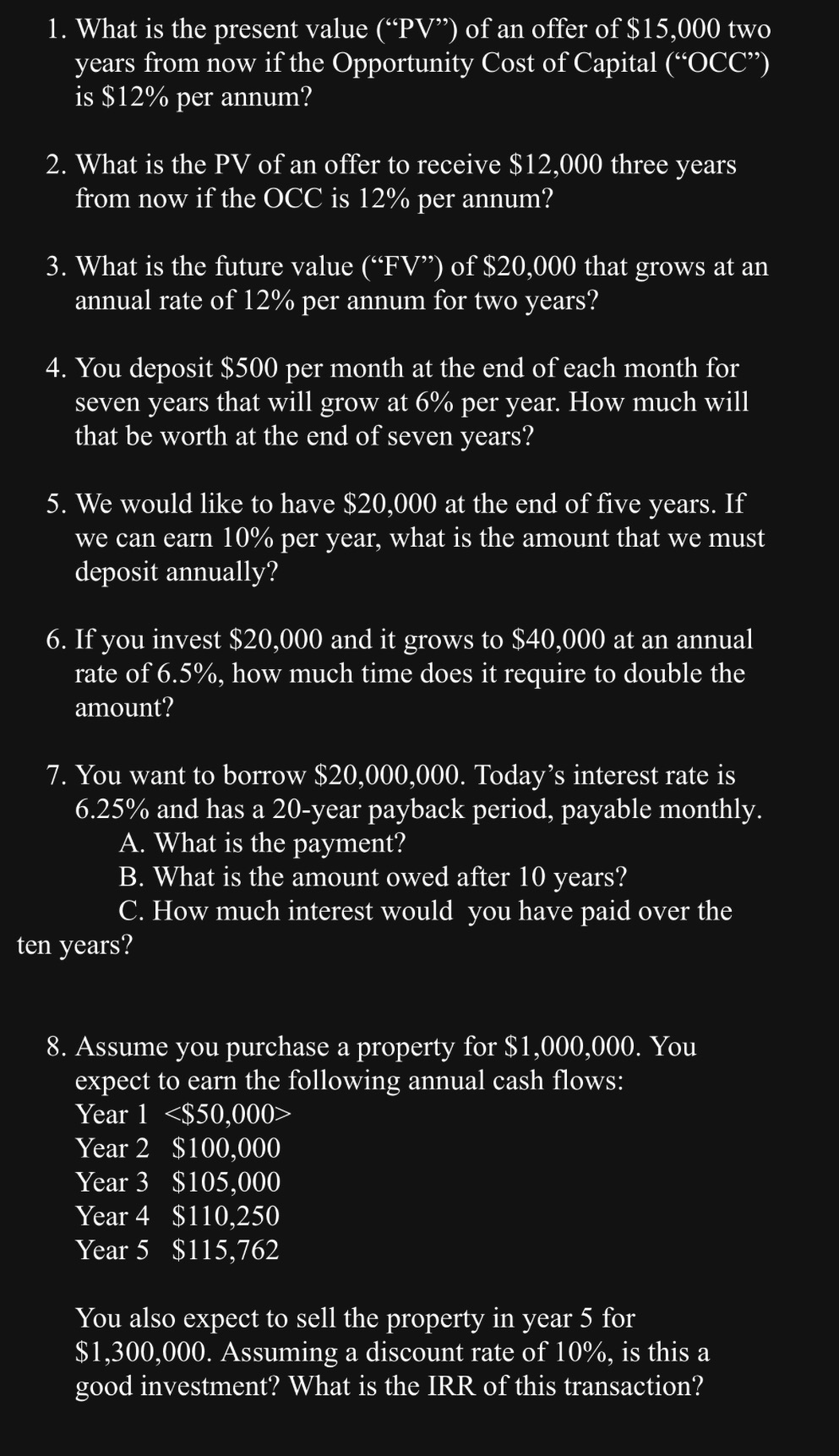

1. What is the present value (PV") of an offer of $15,000 two years from now if the Opportunity Cost of Capital (OCC) is $12% per annum? 2. What is the PV of an offer to receive $12,000 three years from now if the OCC is 12% per annum? 3. What is the future value (FV) of $20,000 that grows at an annual rate of 12% per annum for two years? 4. You deposit $500 per month at the end of each month for seven years that will grow at 6% per year. How much will that be worth at the end of seven years? 5. We would like to have $20,000 at the end of five years. If we can earn 10% per year, what is the amount that we must deposit annually? 6. If you invest $20,000 and it grows to $40,000 at an annual rate of 6.5%, how much time does it require to double the amount? 7. You want to borrow $20,000,000. Today's interest rate is 6.25% and has a 20-year payback period, payable monthly. A. What is the payment? B. What is the amount owed after 10 years? C. How much interest would you have paid over the ten years? 8. Assume you purchase a property for $1,000,000. You expect to earn the following annual cash flows: Year 1 Year 2 $100,000 Year 3 $105,000 Year 4 $110,250 Year 5 $115,762 You also expect to sell the property in year 5 for $1,300,000. Assuming a discount rate of 10%, is this a good investment? What is the IRR of this transaction?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solutions to your financial questions 1 Present Value PV of 15000 in two years at 12 OCC PV Future V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started