Question: The Outdoor Dining Company specializes in producing a set of wood patio furniture consisting of a table and four chairs. The set enjoys great popularity,

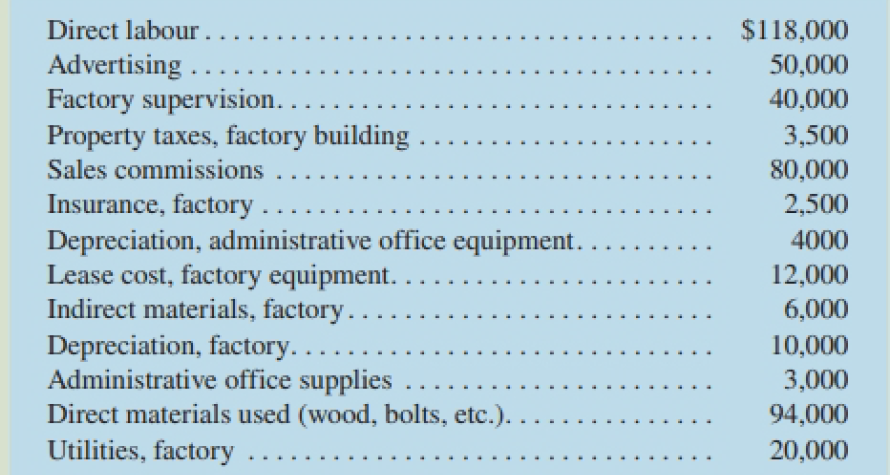

The Outdoor Dining Company specializes in producing a set of wood patio furniture consisting of a table and four chairs. The set enjoys great popularity, and the company has ample orders to keep production going at its full capacity of 2,000 sets per year. Annual cost data at full capacity follow:

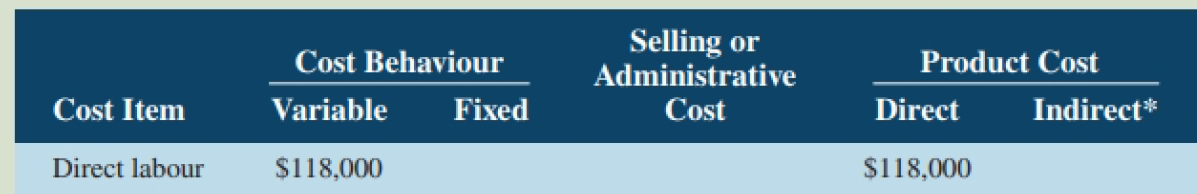

Prepare an answer sheet with the column headings shown below. Enter each cost item on your answer sheet, placing the dollar amount under the appropriate headings. As an example, this has already been done for the first item in the list above. Note that each cost item is classified in two ways: first, as either variable or fixed with respect to the number of units produced and sold, and second, as either a selling and administrative cost or a product cost. (If the item is a product cost, it should also be classified as either direct or indirect, as shown.)

*To units of product.

2. Total the dollar amounts in each of the columns in ( 1) above. Compute the average product cost per patio set.

3. Due to reduced demand, assume that production drops to only 1,000 sets per year. Would you expect the average product cost per patio set to increase, decrease, or remain unchanged? Explain. No computations are necessary.

4. Refer to die original data. The president's sister has considered making herself a patio set and has priced the necessary materials at a building supply store. As an alternative, she has asked the president whether she could purchase a patio set from the Outdoor Dining Company "at cost," and the president has agreed to let her do so.

a. Would you expect any d is agreement between the two over the price the sister should pay? Explain. What price does the president probably have in mind? The sister?

b. Since the company is operating at full capacity, what cost term used in the chapter might be justification for the president to charge the full regular price to his sister and still be selling "at cost"? Explain.

Direct labour. . . Advertising .... Factory supervision. . Property taxes, factory building. $118,000 50,000 40,000 3,500 80,000 2,500 Sales commissions Insurance, factory . . Depreciation, administrative office equipment.. Lease cost, factory equipment. Indirect materials, factory.. Depreciation, factory.... Administrative office supplies Direct materials used (wood, bolts, etc.). Utilities, factory. 4000 12,000 6,000 10,000 3,000 94,000 20,000 Selling or Administrative Cost Behaviour Product Cost Cost Item Variable Fixed Cost Direct Indirect* Direct labour $118,000 $118,000

Step by Step Solution

3.39 Rating (174 Votes )

There are 3 Steps involved in it

1 Cost Behavior Selling or Administrative Product Cost Cost Item Variable Fixed Cost Direct Indirect ... View full answer

Get step-by-step solutions from verified subject matter experts