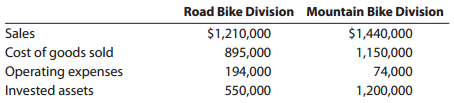

The vice president of operations of Cantor Bike Company is evaluating the performance of two divisions organized

Question:

1. Prepare condensed divisional income statements for the year ended December 31, 2012, assuming that there were no service department charges.

2. Using the DuPont formula for rate of return on investment, determine the profit margin, investment turnover, and rate of return on investment for each division.

3. If management€™s minimum acceptable rate of return is 16%, determine the residual income for each division.

4. Discuss the evaluation of the two divisions, using the performance measures determined in parts (1), (2), and (3).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: