Question: Using the rate calculated in question 6, what is the full manufacturing cost per unit of the deluxe product? a. ($50.) b. ($100.) c. $175.

Using the rate calculated in question 6, what is the full manufacturing cost per unit of the deluxe product?

a. \($50.\)

b. \($100.\)

c. $175.

d. $225.

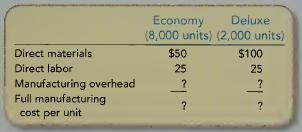

Hi-Def Video Company makes two types of digital DVD players, economy and deluxe, with the following per unit cost information:

The company currently applies \($1\) million in manufacturing overhead to the two products on the basis of direct labor hours. Both products require two hours of direct labor.

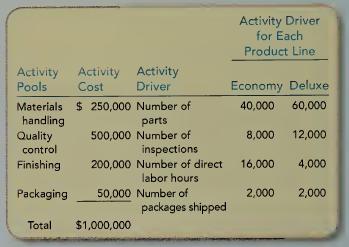

Assume that High-Def has decided to implement an ABC system and has assigned the \($1\) million in manufacturing overhead to four activities, which will be assigned to the two products based on the following activity drivers:

Direct materials Direct labor Manufacturing overhead Full manufacturing cost per unit Economy (8,000 units) (2,000 units) Deluxe $50 $100 25 25 ? ? ? ?

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts