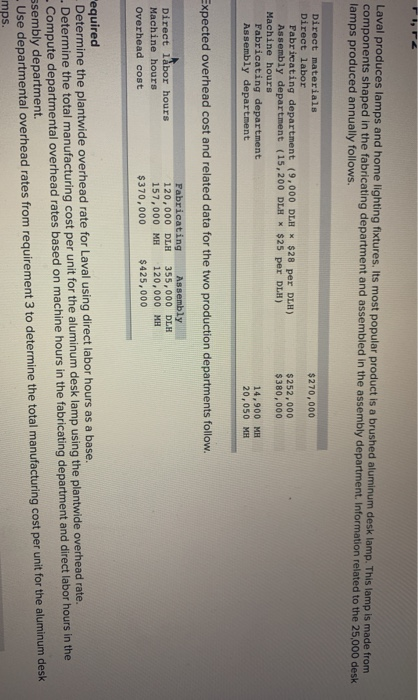

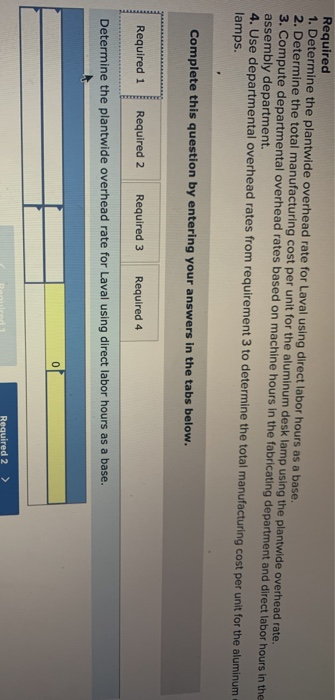

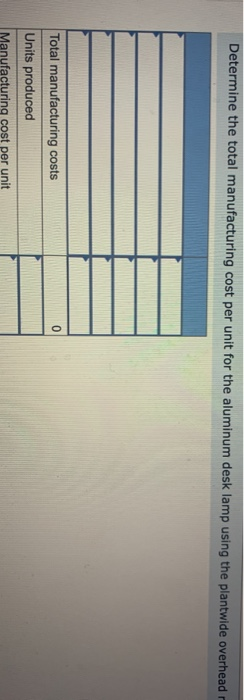

Laval produces lamps and home lighting fixtures, Its most popular product is a brushed aluminum desk lamp his om ma n components shaped in the fabricating department and assembled in the assembly department. Information related to the 25,000 desk lamps produced annually follows. $ 270,000 Direct materials Direct labor Fabricating department (9,000 DLH * $28 per DLH) Assembly department (15,200 DLH * $25 per DLH) Machine hours Fabricating department Assembly department $ 252,000 $380,000 14,900 MH 20,050 MH Expected overhead cost and related data for the two production departments follow. Direct labor hours Machine hours Overhead cost Fabricating 120,000 DLH 157,000 MH $370,000 Assembly 355,000 DLH 120,000 MH $425,000 "equired Determine the plantwide overhead rate for Laval using direct labor hours as a base. Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate. Compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the ssembly department. Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk mps. Required 1. Determine the plantwide overhead rate for Laval using direct labor hours as a base. 2. Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate. 3. Compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department. 4. Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum lamps. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine the plantwide overhead rate for Laval using direct labor hours as a base. Required 2 > Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead Total manufacturing costs Units produced Manufacturing cost per unit Compute departmental overhead rates based on machine hours in the fabricating department a assembly department. (Round your answers to 2 decimal places.) Departmental overhead rate MH Fabricating Assembly DLH Required 1 Required 2 Required 3 Required 4 Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps. Direct labor Overhead o per unit Required a Way Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly in its inishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow Process Activity components changeover Machining Setups Driver Number of batches Machine hours Number of setups Quantity 830 8.400 120 Finishing Welding Inspecting Rework Overhead Cost $ 593, 450 394,800 217,800 $1,206,050 $ 311,240 269,325 34,400 $ 614,965 $ 213,200 30,900 137,400 $ 381,500 Welding hours Number of inspections Rework orders 6,200 855 160 Support Purchasing Providing space Providing utilities Purchase orders Number of units Number of units 533 9,000 9,000 Additional production information concerning its two product lines follows. Units produced Welding hours Batches Number of inspections Machine hours Setups Rework orders Purchase orders Model 145 3,000 2,400 415 495 3,050 Model 212 6,000 3,800 415 360 5, 350 60 120 40 178 355 required 1. Using ABC, compute the overhead cost per unit for each product line. 2. Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $220 for Model 145 and $120 for Model 212. 3. If the market price for Model 145 is $570,29 and the market price for Model 212 is $312.63, determine the profit or loss per unit for each model. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using ABC, compute the overhead cost per unit for each product line. (Round your final answers to 2 decimal places) Model 145 Activity driver Overhead incurred assigned Activity Expected Costs Expected Activity Activity Rate Components Changeover Machining 593,450 394,800 217,800 830 Number of batches 8,400 Machine hours 120 Setups Setups Finishing Welding $ 311,240 269,325 34,400 6.200 Welding hours 855 Inspections 160 Rework orders Inspecting Rework Support Purchasing 213,200 533 Purchase orders Using ABC, compute the overhead cost per unit for each product line. (Round your final answers to 2 decimal places.) Activity Expected Costs Expected Activity Model 145 Activity driver Overhead incurred signed Activity Rate ACL 593,450 394,800 217,800 830 Number of batches 8,400 Machine hours 120 Setups Components Changepver Machining Setups Finishing Welding Inspecting Rework Support Purchasing Providing space and utilities 6 311,240 269,325 34,400 ,200 Welding hours 855 Inspections 160 Rework orders 213,200 168,300 533 Purchase orders 9,000 units Total overhead cost Total units produced Overhead cost per unit Help Save & Exit S Check my w for each product line. (Round your final answers to 2 decimal places.) osts Expected Activity Activity Rate Model 145 Activity driver Overhead incurred assigned Model 212 Activity driver Overhead incurred assigned , 450 800 800 830 Number of batches 8,400 Machine hours 120 Setups 240 325 6,200 Welding hours 855 Inspections 160 Rework orders 200 200 100 533 Purchase orders 9.000 Units Total overhead cost Total units produced Overhead cost per unit Required 2 > Prex 1 of 1 !!! Next Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $220 145 and $120 for Model 212. (Round your final answers to 2 decimal places.) Model 145 Model 212 Materials and Labor per unit Overhead cost per unit Total cost per unit Required 1 Required 3 > Required 1 Required 2 Required 3 If the market price for Model 145 is $570.29 and the market price for Model 212 is $312.63, determine the profit or loss per unit for each model. (Round your final answers to 2 decimal places.) Model 145 Model 212 Price per unit Cost per unit Profit (loss) per unit