Hilltop Raceway Corporation has been formed to develop a 100-acre site into a motor-racing facility. At this

Question:

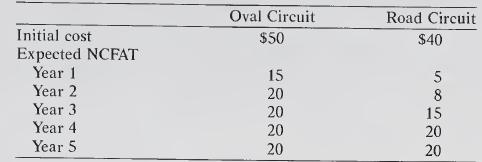

Hilltop Raceway Corporation has been formed to develop a 100-acre site into a motor-racing facility. At this point the final decision has not yet been made whether it will be an oval circuit with only four banked left-hand turns or a road circuit with about ten turns both to the left and the right. The HCR management knows there is more spectator support for oval racing and that a new circuit like this would get on the Indy-car schedule as well as the stock-car schedules organized by CART (Confederation of Auto Racing Teams), which have a tremendous follow¬ ing. But an oval circuit would involve much greater initial costs to level the hill and install the racetrack and spectator stands. A road circuit, on the other hand, would use the terrain to advantage and be considerably less expensive to set up. The road circuit would probably attract the Indy cars but not the CART stock cars; however, it would become a regular feature on the USAC (United States Automobile Club) calendar and might possibly attract the Formula One circus after two or three years of operation. USAC events have many more competitors but fewer spectators than CART events and thus are less profitable to the promoters. Formula One events are very profitable and involve a great deal of prestige for the racetrack owners, as well as recip¬ rocal benefits at other race circuits around the world. The cash-flow details (in millions) are presented below. Assume year-end cash flows.

Expected resale value after five years (for condominium development) is $30 million if the landscape is modified for an oval track and $50 million if the land is used for a road-racing tiack. The firm s cost of capital will be 17 percent if it raises $50 million but only 14 percent if it only has to raise $20 million.

(a) Calculate the expected net present value of the two alternatives.

(b) Estimate the payback period for each alternative.

(c) Advise Hilltop Raceway as to what they should do.

(d) What assumptions and qualifications underlie your advice?

Step by Step Answer: