taxes and incentives Consider a setting where the manager' s input ean be L or H and

Question:

taxes and incentives Consider a setting where the manager' s input ean be L or H and the output ean be Xl = 10,000 or x2 = 50,000. The manager' s preferenees are described in the usual fashion, with utility for wealth w given by U(W) = -exp(-rW), where w is the net of payment I and personal eost ea' Let r = .0001. Also, the manager's opportunity eost of working for this organization is U(M), with M = O. The owner is risk neutraI.

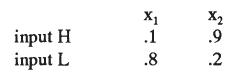

The output probabilities are:

Assume eH = eL = 5,000. Input H is desired throughout the exereise.

a] Detennine and interpret an optimal contraet.

b] Suppose the owner is subjeet to a 20% income tax (Le., a tax equal to 20% of the net of Xi - I;), while the manager faees a zero marginai tax rate. Detennine and interpret an optimal contraet.

e] Repeat [b] above for the ease where the owner is subjeet to a 20% income tax on income in excess of 20,000.

d] Repeat [e] above for the ease eL = 4,000.

e] Repeat [e] above for the ease eL = O.AppendixLO1

Step by Step Answer: