Reginald Jones, director of sales and marketing of the 128-room Indianapolis Princess Suites, strongly subscribes to the

Question:

Reginald Jones, director of sales and marketing of the 128-room Indianapolis Princess Suites, strongly subscribes to the 80-20 rule when it comes to marketing. He feels that if 80 percent of his business comes from 20 percent of his customers, then he should know as much as possible about his best customers. He thinks about his pricing strategy, which gives discounted pricing to his better customers, and wonders if the rates charged can be justified.

The first Princess Suites was built in 1994 outside of Cleveland, Ohio, and the chain has expanded to its current size of 64 hotels. These limitedservice hotels offer a queen-size bed or two double beds, a 25-inch television with remote control and cable, and a fully equipped kitchen with a two-burner cooking surface, full-size refrigerator, microwave, coffeemaker, and cooking utensils. Also standard for each room is a sofa sleeper, dining table and chairs, and a free local paper. Princess Suites offers free local phone calls, voice mail, access to a fax machine, a 24-hour coin-operated guest laundry facility, an outdoor swimming pool, and a fitness room.

The Indianapolis Princess Suites, located on the south side of Indianapolis, ran a 54.2 percent occupancy last year with an average daily rate of $62.21.

They generally sell out on Tuesday and Wednesday nights and occasionally on Monday and Thursday, but they turn away a lot of walk-ins on sold-out nights; these potential customers do not have a negotiated rate and would pay the higher corporate rate. There is little all-suite competition except for a Mickey Suites located across the Interstate.

Chris Wood, the GM of Princess Suites, feels that Princess Suites must offer the same amenities as Mickey Suites in order to directly compete with them. Princess Suites offers a complimentary breakfast as well as a complimentary beer and wine happy hour to all of its guests. Two full-service hotels, the Pacerd Inn and the Macron Hotel, are close, but Chris does not view them as direct competition. The Pacerd and Macron both have bell service, restaurants serving three meals a day, room service, and meeting facilities that are not available at the Princess Suites. Their rates are significantly higher than the Princess Suites rates, as evidenced by the latest shopping survey: the Pacerd charges a corporate rate of $99 and the Macron charges a $94 corporate rate. Reginald takes advantage of co-op advertising dollars offered by Princess Suites by advertising in USA Today and Business Week. There is a listing in the AAA book, and he takes out a half-page ad in the Indianapolis yellow pages. The local cable channel has been courting him lately, but he feels that television and the local paper are not effective uses of his money. Reginald has been exploring billboard advertising, but he is not familiar with this medium and its effectiveness.

Princess Suites has created a Secretary’s Club to reward secretaries when they book the hotel. Every 15 room nights booked at a net rate results in a

$15 gift certificate to a local restaurant of their choice. Reginald allows local restaurants to put fliers in the guest rooms in exchange for $45 worth of gift certificates per month. He also purchases additional certificates from the restaurants as needed. Last year alone, he distributed over $1,200 worth of certificates to the Secretary’s Club, which he sees as 1,200 room nights he would not have sold without the club.

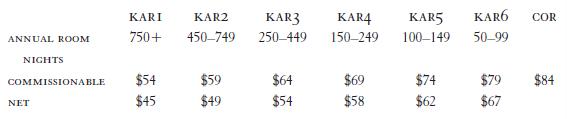

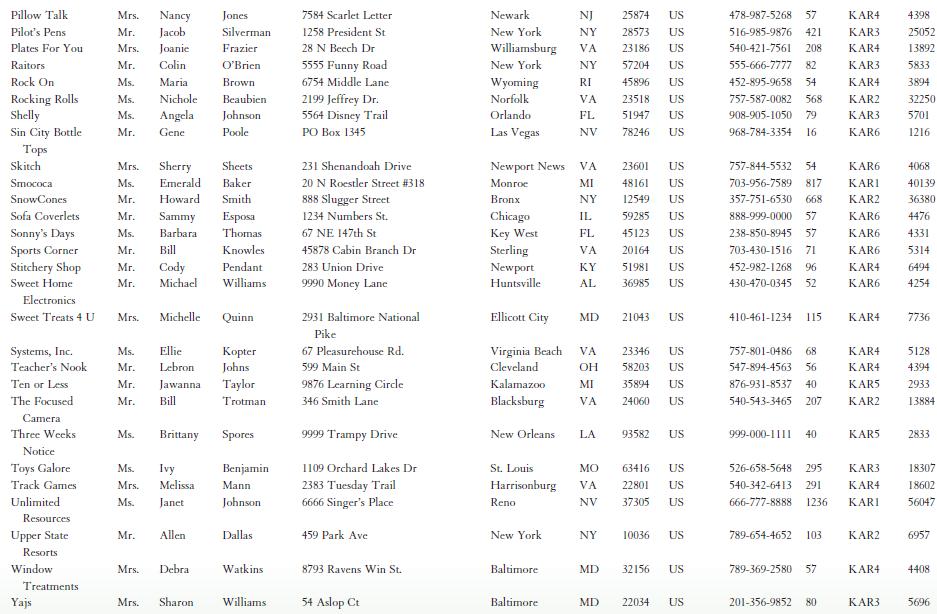

Princess has negotiated rates with Fortune 500 companies over the years using its KAR (key account rate) strategy. The biggest accounts (over 750 room nights per year) receive the lowest negotiated rate, the KAR1 rate. The next largest accounts (450–749 rooms per year) receive the KAR2 rate. This tiered system continues up to the KAR6 rate, which is charged to the smaller local accounts. All KAR rates are commissionable, so many companies want their KAR rates quoted as a net rate (KAR rate minus 10 percent commission).

Anyone who does not qualify for the KAR rate is quoted the corporate rate. A sample rate scheme from the Indianapolis Princess Suites is shown below:

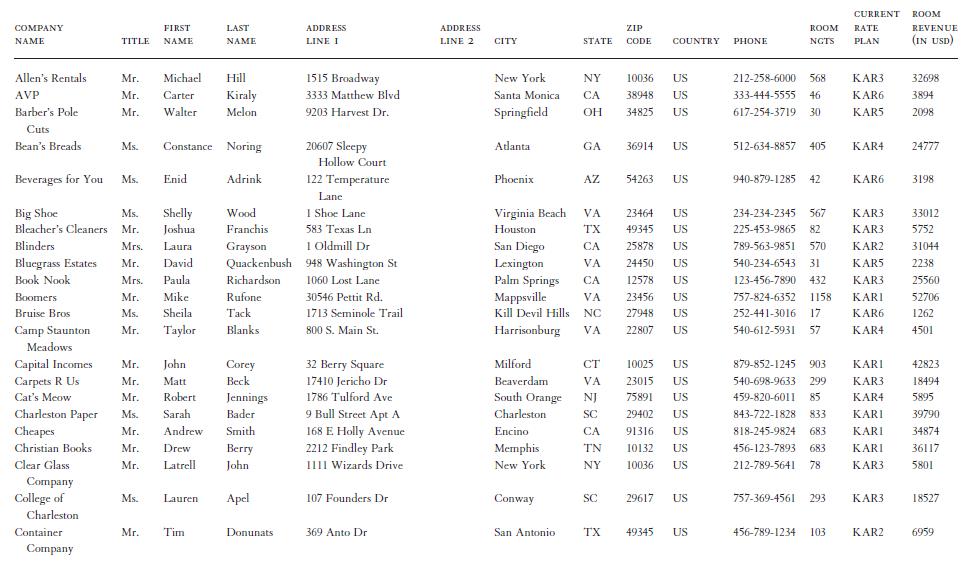

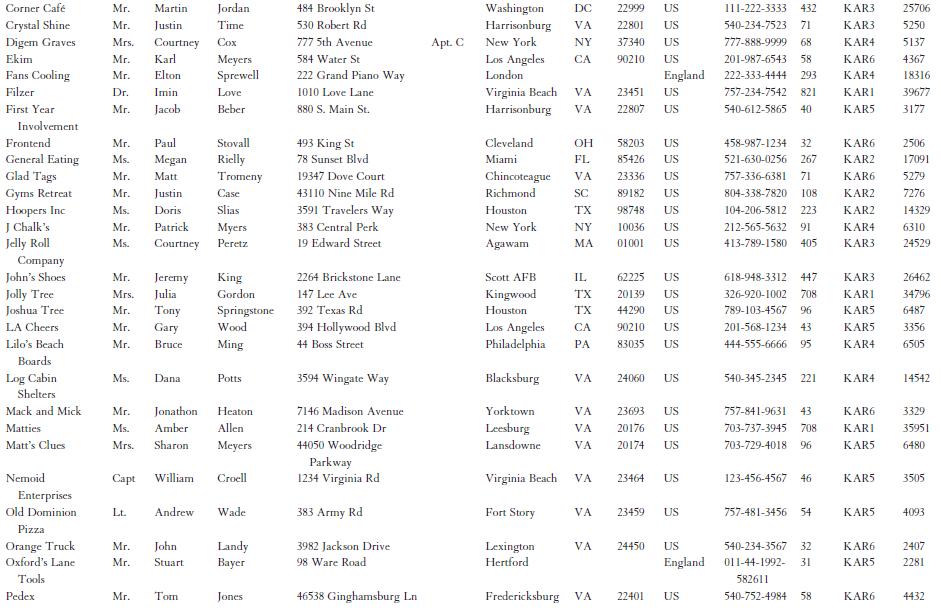

Reginald frequently looks through his customer contact list. Some clients have dropped off in production, but they are still receiving the discounts given to higher-volume customers. Therefore, he has decided to look at volume and find out which clients truly produce 80 percent of his business. By looking at guest history, he wants to determine if the number of room nights increases as the price decreases, or if the rate structure should be simplified. He also wonders if some companies are showing lower production because their employees are not receiving the negotiated rate and thus are not being tracked.

He wonders if some companies would pay more to receive additional benefits (such as direct billing, on-demand movies, etc.) or if they are price sensitive.........

Case Study Questions and Issues

1. Reginald is faced with a huge dilemma. He could have a public relations nightmare if some of his customers wind up badmouthing Princess Suites and going elsewhere because their rates were raised. Do you think he will lose business or do you think that most of the customers will stay and pay the higher rate?

2. Last year the Indianapolis Princess Suites sold only 25,322 room nights for a 54.2 percent occupancy rate. How much business do you think the Princess Suites might lose as a result of raising their negotiated rates?

3. Even though the Princess Suites may lose some negotiated-rate customers and may tarnish its reputation due to the rate increase, they will now have rooms available Monday–Thursday for customers paying higher rates. Do you think it is worth taking the chance that they can replace existing negotiated-rate customers with corporate rates and other higher-rate business?

4. Are there any customers that you would allow to pay a lower negotiated rate than their production suggests they should pay?

Step by Step Answer:

Hospitality Marketing Management

ISBN: 9780471476542

4th Edition

Authors: Robert D Reid, David C Bojanic