Consider a forward contract, where the buyer is under the obligation to purchase one unit of stock

Question:

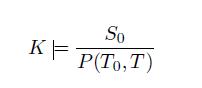

Consider a forward contract, where the buyer is under the obligation to purchase one unit of stock at some future time T , for an agreed price K. Consider first the case of no dividends or borrow costs. Show, that by shorting one unit of stock at a price S0 today, and investing the proceeds in zero coupon bonds paying unity at T , the fair strike for the contract is given by:

where P(T0, T ) is the value of the zero coupon bond paying unity at expiry. In the case where rates rt are deterministic, show that the bond price is given by:

(Hint: consider shorting the bond and investing the proceeds in a cash account accruing interest at rate r(t).)

Now consider the case where the stock pays a continuous dividend yield, such that the dividend paid out to a stock holder over the interval [t, t + dt] is given by Stq(t)dt. By considering a total return strategy, where the dividend is continuously reinvested into stock, show that the starting short position in stock consists of ![]() shares. Use this result to show, in the case where both the dividend yield and rates are deterministic, that the fair strike of the forward contract is given by:

shares. Use this result to show, in the case where both the dividend yield and rates are deterministic, that the fair strike of the forward contract is given by:

Step by Step Answer:

The Value Of Uncertainty Dealing With Risk In The Equity Derivatives Market

ISBN: 9781848167728,9781908979582

1st Edition

Authors: George Kaye