Consider the same financial market as in Problem 5.5. Imagine at t = 0 an agent forms

Question:

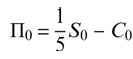

Consider the same financial market as in Problem 5.5. Imagine at t = 0 an agent forms the portfolio

What is the payoff ∏1 of this portfolio and which security does it replicate? Can you derive the fair price C0 from the replicating portfolio?

Problem 5.5.

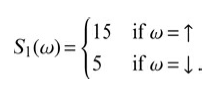

Imagine a financial market with one zero-coupon bond and one stock. The risk-free rate of interest over one period of time is r = 25% and the initial value of the stock is S0 = $10. There are two possible states of the world at t = 1, say “up” and “down,” and the stock takes values

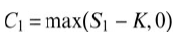

Now a call option on the stock is introduced into the market. Its payoff function is

with exercise price K = $13. Compute the risk neutral probabilities and the fair price C0 of the derivative contract.

Step by Step Answer: