Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns

Question:

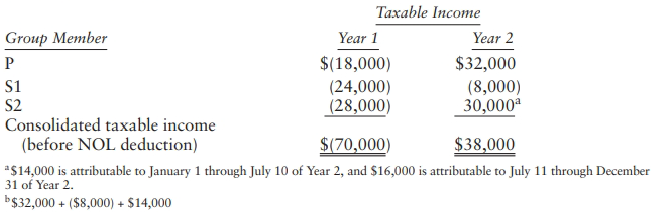

Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 3, P sells all of its 52 stock. The group reports the following results:

In what year(s) can the corporations deduct the Year 1 consolidated NOL? Assume that Year 1 is 2018 or a later year.

Transcribed Image Text:

Тахаble Income Group Member Year 1 Year 2 $(18,000) (24,000) (28,000) $32,000 (8,000) 30,000° S1 S2 Consolidated taxable income (before NOL deduction) *$14,000 is attributable to January 1 through July 10 of Year 2, and $16,000 is attributable to July 11 through December $(70,000) $38,000 31 of Year 2. b$32,000 + ($8,000) + $14,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

The group first carries over the 70000 NOL to Year 2 offsetting 30400 080 380...View the full answer

Answered By

Akshay Singla

as a qualified engineering expert i am able to offer you my extensive knowledge with real solutions in regards to planning and practices in this field. i am able to assist you from the beginning of your projects, quizzes, exams, reports, etc. i provide detailed and accurate solutions.

i have solved many difficult problems and their results are extremely good and satisfactory.

i am an expert who can provide assistance in task of all topics from basic level to advance research level. i am working as a part time lecturer at university level in renowned institute. i usually design the coursework in my specified topics. i have an experience of more than 5 years in research.

i have been awarded with the state awards in doing research in the fields of science and technology.

recently i have built the prototype of a plane which is carefully made after analyzing all the laws and principles involved in flying and its function.

1. bachelor of technology in mechanical engineering from indian institute of technology (iit)

2. award of excellence in completing course in autocad, engineering drawing, report writing, etc

4.70+

48+ Reviews

56+ Question Solved

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted:

Students also viewed these Business questions

-

P and S Corporations comprise an affiliated group that files separate tax returns. P and Shad no intercompany inventory sales before the current year (Year 1). P and S use the first-in, first-out...

-

What is the purpose of the gift tax annual exclusion?

-

In March 1976, Sue made a taxable gift of $200,000. In arriving at the amount of her taxable gift, Sue elected to deduct the $30,000 specific exemption then available. In 2018, Sue makes her next...

-

Jacky Ma Ltd sells a single product called Alibaba. During 2020, 10,000 units were produced and 9,500 units were sold. There was no work-in-process inventory on 31 December 2020, that is the...

-

Find the (straight-line) distance between the points whose spherical coordinates are (8, /4, /6) and (4, /3, 3/4).

-

A family of four people check in their suitcases at the airport. The weights of the four cases are 18.5kg, 26kg, 15.4kg and 23.7kg. a. Calculate the total weight of the four cases. b. The weight...

-

List various classifications of capital expenditures that might permit easier evaluation by management. LO.1

-

1. What is wrong with this surveillance log? 2. Why is it important to take detailed notes during surveillance and covert operations? The following surveillance log was taken during two fixed-point...

-

Financial Management Explain Cash Models, Planning, Forecasting & Budgeting

-

Santos Ltd has 3 business segments: Gold, Copper and Silver. The business segment information for the year ended 30 June 2022 is given as follows: Revenue($) Profit/(Loss)($) Asset Gold 2,240,000...

-

P and S Corporations form in Year 1, with S as P's wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results: In what...

-

P Corporation owns 100% of S Corporation's stock, and S owns 100% of T Corporation's stock. The three corporations have filed consolidated tax returns for several years. On January 1 of the current...

-

Mr. Smith wishes to sell a bond that has a face value of $1,000. The bond bears an interest rate (coupon rate) of 7.5%, with bond interest payable semiannually. Four years ago, the bond was purchased...

-

1 . Journalize the following transactions: ( a ) Issued 1 , 0 0 0 shares of $ 1 0 par common stock at $ 5 9 for cash. ( b ) Issued 1 , 4 0 0 shares of $ 1 0 par common stock in exchange for equipment...

-

Using alpha .05, determine if moving to a larger enclosure decreased tiger anxiety levels. You should first calculate the difference (After - Before) Tiger Before Anthony 45 45 Banthony 56 After 38...

-

Cyclohexane (C 6 H 12 ) is produced by mixing Benzene and hydrogen. A process including a reactor, separator, and recycle stream is used to produce Cyclohexane. The fresh feed contains 260L/min C 6 H...

-

Suppose the city is undergoing severe ination. Specifically, both goods prices have risen by 10%. What percentage of a raise in the wage rate should Alex request from her boss, for her to maintain...

-

1. An iron cube of mass 0.55 kg is raised to a temperature of 100C by being placed in boiling water for 5 minutes. It is then removed and transferred immediately to an aluminium calorimeter filled...

-

For the following exercises, find the exact value using half-angle formulas. cos (11/12)

-

Differentiate the following terms/concepts: a. Personality types and money attitudes b. Planners and avoiders c. Moderating and adapting to biases d. "Perfectible judges" and "incorrigible judges"

-

Consumer services tend to be intangible, and goods tend to be tangible. Use an example to explain how the lack of a physical good in a pure service might affect efforts to promote the service.

-

Explain some of the different aspects of the customer experience that could be managed to improve customer satisfaction if you were the marketing manager for: ( a ) an airport branch of a rental car...

-

Is there any difference between a brand name and a trademark? If so, why is this difference important?

-

business law A partner may actively compete with the partnership True False

-

A company provided the following data: Selling price per unit $80 Variable cost per unit $45 Total fixed costs $490,000 How many units must be sold to earn a profit of $122,500?

-

Suppose a 10-year, 10%, semiannual coupon bond with a par value of $1,000 is currently selling for $1,365.20, producing a nominal yield to maturity of 7.5%. However, it can be called after 4 years...

Study smarter with the SolutionInn App