P and S Corporations form in Year 1, with S as P's wholly-owned subsidiary. The corporations immediately

Question:

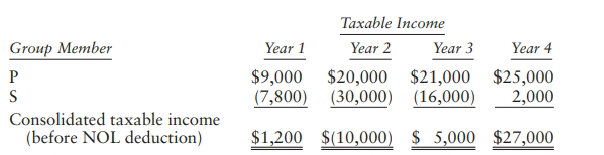

P and S Corporations form in Year 1, with S as P's wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results:

In what year(s) can the group deduct the Year 2 consolidated NOL? Assume that Year 2 is 2018 or a later year.

Transcribed Image Text:

Тахаble Incomе Group Member Year 1 Year 2 $9,000 $20,000 (7,800) (30,000) (16,000) Year 4 Year 3 $21,000 $25,000 2,000 Consolidated taxable income (before NOL deduction) $1,200 $(10,000) $ 5,000 $27,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

4000 in Year 3 and 6000 in Year 4 Because the NOL arose in 2018 o...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf

Question Posted:

Students also viewed these Business questions

-

Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 3, P sells...

-

Alice, a married taxpayer, will form Morning Corporation in the current year. Alice plans to acquire all of Morning's common stock for a $1 mill ion contribution to the corporation. Morning will...

-

Refer to the facts of Problem C: 12-36 and assume the current year is 2018. Emily's prior gifts are as follows: Year . . . . . . . . . . . . . . . . . . . . Amount of Taxable Gifts 1974 . . . . . . ....

-

The CFO of the Jordan Microscope Corporation intentionally misclassified a downstream transportation expense in the amount of $575,000 as a product cost in an accounting period when the company made...

-

Find the acute angle between the planes 2x - 4y + z = 7 and 3x + 2y - 5z = 9.

-

Multiply the following numbers by 102. a. 45 b. 7.2 c. 0.96 d. 0.0485 e. 6.033

-

How, if at all, does the book value of assets being replaced affect the investment decision? LO.1

-

On January 1, 2010, Crouser Company sold land to Chad Company, accepting a two-year, $150,000 non-interest-bearing note due January 1, 2012. The fair value of the land was $123,966.90 on the date of...

-

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash $ 7,800 Accounts receivable $ 21,200 Inventory $ 41,400...

-

Westfield Capital Management Co.s equity investment strategy is to invest in companies with low price-to-book ratios, while considering differences in solvency and asset utilization. Westfield is...

-

Peoria and Salem Corporations have filed consolidated tax returns for several years. For the current year, consolidated taxable income is $300,000. The consolidated general business credit (computed...

-

P Corporation owns 100% of S Corporation's stock, and S owns 100% of T Corporation's stock. The three corporations have filed consolidated tax returns for several years. On January 1 of the current...

-

Identify and explain each of the elements of a right of publicity claim.

-

1 Evaluate the given limits using the 10. f(x) = (x-3)(x-5) (a) lim f(x) X-3 (b) lim f(x) x-3+ (c) lim f(x) X-3 graph of the function (d) lim f(x) x+5= (e) lim f(x) x+5+ (f) lim f(x) X-5 50 y -50 2 6...

-

In Year 1 , Stallman Co . had a break - even point of 8 0 , 0 0 0 units, a selling price of $ 1 9 per unit, and fixed costs of $ 2 0 0 , 0 0 0 . What is Stallman Co . s variable cost per unit? (...

-

What will be the output of following statements: int a = 3; if(a!= 3){ cout

-

28. What will this program print, assuming dynamic scoping? (10 points) Consider the following code snippet for problems #29-31. For this problem, assume dynamic scoping. program main() 1. 2. { 3. 4....

-

The reaction X + Y products was studied using the method of initial rates. The initial rate of consumption of X was measured in three different experiments. Data are provided below. Expt [X] 0 (in...

-

For the following exercises, use the fundamental identities to fully simplify the expression. tan x csc x tan x + 1 + tan x 1+cot x 1 cos x

-

The diameter of a sphere is 18 in. Find the largest volume of regular pyramid of altitude 15 in. that can be cut from the sphere if the pyramid is (a) square, (b) pentagonal, (c) hexagonal, and (d)...

-

Discuss several ways in which physical goods are different from pure services. Give an example of a good and then an example of a service that illustrates each of the differences.

-

What products are being offered by a shop that specializes in bicycles? By a travel agent? By a supermarket? By a new car dealer?

-

Identify the determining dimension or dimensions that explain why you bought the specific brand you did in your most recent purchase of a ( a ) soft drink, ( b ) shampoo, ( c ) shirt or blouse, and (...

-

Milano Pizza is a small neighborhood pizzeria that has a small area for in-store dining as well as offering take-out and free home delivery services. The pizzerias owner has determined that the shop...

-

Which of the following statement regarding a post-closing trial balance is not true

-

What are the benefits and potential risks factors for undertaking derivative strategies compared to cash transactions

Study smarter with the SolutionInn App