Sid Kess, a long-time tax client of yours, has decided to acquire the snow blower manufacturing firm

Question:

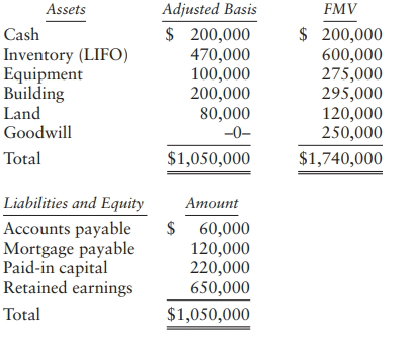

Sid Kess, a long-time tax client of yours, has decided to acquire the snow blower manufacturing firm owned by Richard Smith, one of his closest friends. Richard has a $200,000 adjusted basis in his Richard Smith Snow Blowers (RSSB) stock. Sid Kess Enterprises (SKE), a C corporation 100%-owned by Sid Kess, will make the acquisition. RSSB operates as a C corporation and reports the following assets and liabilities as of November 1 of the current year.

RSSB has claimed depreciation of $200,000 and $80,000 on the equipment and building, respectively, and has claimed no amortization on the goodwill. Retained earnings approximate RSSB's E&P. No NOL, capital loss, or credit carryovers exist at the time of the acquisition. What are the tax consequences of each alternative acquisition transaction to SKE and RSSB? Assume a 21% corporate tax rate.

a. SKE acquires all the single class of RSSB stock for $1.56 million in cash. RSSB is not liquidated.

b. SKE acquires all the noncash assets of RSSB for $1.54 million in cash. RSSB is liquidated.

c. SKE acquires all the RSSB stock for $1.56 million in cash. RSSB is liquidated into SKE shortly after the acquisition.

d. SKE acquires all the RSSB stock for $1.56 million in cash. SKE makes a timely Sec. 338 election. Assume that RSSB's corporate tax rate is 21%.

e. SKE exchanges $1.54 million of its common stock for all of RSSB's noncash assets ($1,540,000 = $1,740,000 total assets- $200,000 cash). SKE has 10,000 shares of stock outstanding with a $3 million FMV before the acquisition. RSSB liquidates as part of the transaction. RSSB uses part of the retained cash to pay off the corporation's liabilities. The remaining cash is distributed along with the SKE stock in the liquidation of RSSB.

f. SKE exchanges $1.56 million of its common stock for all of Richard Smith's RSSB stock. Assume that RSSB does not liquidate. Each share of SKE stock has a $300 FMV.

g. Assume the same facts as in Part d except SKE transfers $1.56 million of its common stock to SKE-Sub. In the transaction, SKE-Sub is the acquiring corporation and uses $1.56 million of the SKE stock to acquire RSSB's stock.

h. Assume the same facts as in Parte except SKE transfers $1.54 mill ion of its common stock to SKE-Sub. In the transaction, SKE-Sub is the acquiring corporation and uses $1.54 million of the SKE stock to acquire RSSB's noncash assets.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer:

Global Taxation How Modern Taxes Conquered The World

ISBN: 9780192897572

1st Edition

Authors: Philipp Genschel, Laura Seelkopf