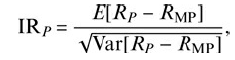

The theoretical information ratio of a portfolio P is defined as where RP is the portfolio return,

Question:

The theoretical information ratio of a portfolio P is defined as

where RP is the portfolio return, and RMP is the return on the market portfolio. Show that this ratio can never be larger than the theoretical Sharpe-ratio of the market portfolio, if the CAPM holds.

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: