A firm is an entity that consists of its assets and let At denote the market value

Question:

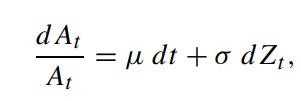

A firm is an entity that consists of its assets and let At denote the market value of the firm’s assets. Assume that the total asset value follows a stochastic process modeled by

where μ and σ2 (assumed to be constant) are the instantaneous mean and variance, respectively, of the rate of return on At . Let C and D denote the market value of the current liabilities and market value of debt, respectively. Let T be the maturity date of the debt with face value DT . Suppose the current liabilities of amount CT are also payable at time T , and it constitutes a claim senior to the debt. Also, let F denote the present value of total amount of interest and dividends paid over the term T . For simplicity, F is assumed to be prepaid at time t = 0.

The debt is in default if AT is less than the total amount payable at maturity date T , that is,

![]()

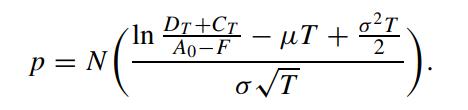

(a) Show that the probability of default is given by

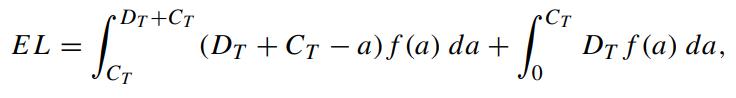

(b) Explain why the expected loan loss L on the debt is given by

where f is the density function of AT . Give the financial interpretation to each of the above integrals.

where f is the density function of AT . Give the financial interpretation to each of the above integrals.

Step by Step Answer: