Consider a self-financing portfolio that contains t units of the underlying risky asset whose price process

Question:

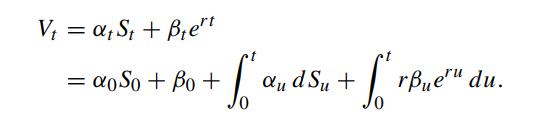

Consider a self-financing portfolio that contains αt units of the underlying risky asset whose price process is St and βt dollars of the money market account with riskless interest rate r. Suppose the initial portfolio contains α0 units of the risky asset and β0 dollars of money market account. Show that the time-t value of the portfolio value Vt is given by

Transcribed Image Text:

V₁ = at St + B₁e¹t = αoSo + Po + So 0 So aud Su + + rBueu du.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

A selffinancing portfolio is a portfolio in which the purchase of a new asset is financed by the sale of an old asset without any additional injection or withdrawal of funds In other words the total v...View the full answer

Answered By

Mary Boke

As an online tutor with over seven years of experience and a PhD in Education, I have had the opportunity to work with a wide range of students from diverse backgrounds. My experience in education has allowed me to develop a deep understanding of how students learn and the various approaches that can be used to facilitate their learning. I believe in creating a positive and inclusive learning environment that encourages students to ask questions and engage with the material. I work closely with my students to understand their individual learning styles, strengths, and challenges to tailor my approach accordingly. I also place a strong emphasis on building strong relationships with my students, which fosters trust and creates a supportive learning environment. Overall, my goal as an online tutor is to help students achieve their academic goals and develop a lifelong love of learning. I believe that education is a transformative experience that has the power to change lives, and I am committed to helping my students realize their full potential.

5.00+

4+ Reviews

21+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

We would like to examine the credit yield spreads of the floating rate debt and fixed rate debt under the Merton risky bond model with stochastic interest rate (Ikeda, 1995). Let A t and r t denote...

-

1. Which of the following statements about a call option is false? a. A call option is the right, not the obligation, to buy the underlying asset. b. A call option is in the money if the asset price...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Shreya commutes in a CNG fitted van to school every day along with many other students. She told the van driver to get the CNG connection certified and timely checked it for any leakage or loose...

-

Record the following transactions on the books of Carnegie College, a private institution that follows FASB standards. The year is 2012. 1. During 2012, Carnegie received a pledge in the amount of...

-

Consider the following data for the assembly division of Fenton Watches Inc.: The assembly division uses the weighted-average method of process costing. Required Compute equivalent units for direct...

-

On May 3, Zirbal Corporation purchased 4,000 shares of its own stock for $36,000 cash. On November 4, Zirbal reissued 850 shares of this treasury stock for $8,500. Prepare the May 3 and November 4...

-

GASB Statement No. 34 requires reporting using both the financial resources measurement focus and the economic resources measurement focus. How do these two focuses differ, and what impact do they...

-

A bond is currently priced at $1,000. If the bond pays a 4.65% semiannually compounded coupon for the next 25 years, what is the yield to maturity of the bond? (Provide your solution as a decimal...

-

Suppose the cost of carry of a commodity is b. Show that the governing differential equation for the price of the option on the commodity under the Black Scholes formulation is given by where V (S,t)...

-

The following statement is quoted from Black (1989): . . . the expected return on a warrant (call option) should depend on the risk of the warrant in the same way that a common stocks expected return...

-

What is efficiency?

-

My first run at a dissertation was on Dr. Martin Luther King, Jr. When I was very young he walked through my hometown of Albany, Georgia. My father accompanied him, more to protect him than anything,...

-

Question 2 are charged, and the charge on sphere Y is The X and Y dots shown in the figure are two identical spheres, X and Y, that are fixed in place with their centers in the plane of the page....

-

how do i get the residuel income please help in just need the cell formula in excel 2 Genmure Corporation is trying to analyze the results of three efficiency initiatives that were taken on the...

-

Harlow Appliance has just developed a new air fryer it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the below information: a. New...

-

Based on the business that you created a global strategy for in the week 4 discussion, determine a low-cost & differentiation strategy in an effort to remain competitive in the global market. Include...

-

Let R be the region in the first quadrant below the curve y = X-2/3 and to the left of x = 1. (a) Show that the area of R is finite by finding its value. (b) Show that the volume of the solid...

-

All of the following assets can be depreciated, except: (a) A bulldozer (b) A copper mine (c) A surgical robot (d) A conveyor belt

-

People often use shortcuts such as selective perception and stereotyping to judge other people more quickly. What are the good and bad aspects of this type of perceptual fast track?

-

How does perception affect the decision-making process?

-

Describe the steps of the rational decision-making process. Use buying a car as an example.

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App