Portfolio A: One European call option plus X dollars of money market account. Portfolio B: One American

Question:

Portfolio A: One European call option plus X dollars of money market account.

Portfolio B: One American put option, one unit of the underlying asset and borrowing of loan amount D. The loan is in the form of a portfolio of bonds whose par values and dates of maturity match with the sizes and dates of the discrete dividends.

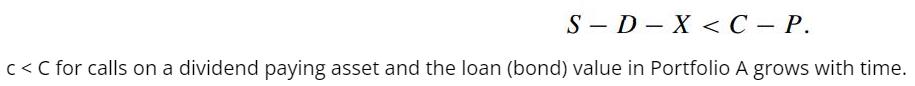

Assume the underlying asset pays dividends and D denotes the present value of the dividends paid by the underlying asset during the life of the option. Show that if the American put is not exercised early, Portfolio B is worth max(ST ,X), which is less than the value of Portfolio A. Even when the American put is exercised prior to expiry, show that Portfolio A is always worth more than Portfolio B at the moment of exercise. Hence, deduce that

Step by Step Answer: