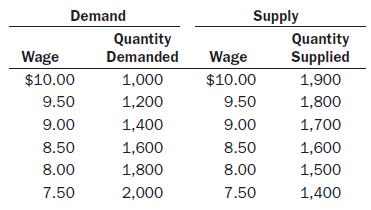

12. The demand and supply schedules for a hypothetical labor market are given in the accompanying table.

Question:

12. The demand and supply schedules for a hypothetical labor market are given in the accompanying table.

a. Find the equilibrium wage and number of workers hired.

b. Suppose that a new law is passed requiring employers to pay an unemployment insurance tax of $1.50 per hour for every employee. What happens to the equilibrium wage rate and number of workers hired? How is this tax burden distributed between employers and workers?

c. Now suppose that rather than being paid by employers, the tax must be paid by workers.

How does this affect the equilibrium wage rate and number of workers hired? How is this tax burden distributed between employers and workers?

d. Does it make a difference who is statutorily liable for the tax?

Step by Step Answer:

Microeconomics Private And Public Choice

ISBN: 9780538754330

13th Edition

Authors: James D. Gwartney