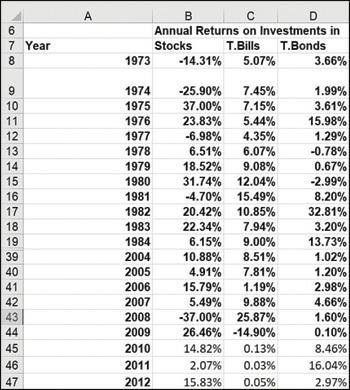

Determine the correlations (based on the 19732012 data) among annual returns on stocks, T-bills, and bonds. Then

Question:

Determine the correlations (based on the 1973–2012 data) among annual returns on stocks, T-bills, and bonds. Then determine the correlations (based on the 1,000 scenarios created by bootstrapping) among the final values for stocks, T-bills, and bonds. Does it appear that the bootstrapping approach picks up the interdependence among the returns on stocks, T-bills, and bonds?

Transcribed Image Text:

6 7 Year 8 9 10 11 12 13 14 15 16 17 18 19 39 40 41 42 43 44 45 46 47 A 1973 B C Annual Returns on Investments in Stocks T.Bills T.Bonds 5.07% 3.66% -14.31% -25.90% 7.45% 37.00% 7.15% 23.83% 5.44% -6.98% 4.35% 6.51% 6.07% 18.52% 9.08% 1974 1975 1976 1977 1978 1979 1980 31.74% 12.04% 1981 -4.70% 15.49% 1982 20.42% 10.85% 1983 22.34% 7.94% 1984 6.15% 9.00% 2004 10.88% 8.51% 2005 4.91% 7.81% 2006 15.79% 1.19% 2007 5.49% 9.88% 2008 -37.00% 25.87% 2009 26.46% -14.90% 2010 14.82% 0.13% 2011 2.07% 0.03% 2012 15.83% 0.05% 1.99% 3.61% 15.98% 1.29% -0.78% 0.67% -2.99% 8.20% 32.81% 3.20% 13.73% 1.02% 1.20% 2.98% 4.66% 1.60% 0.10% 8.46% 16.04% 2.97%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

Based on the given data 19732012 the correlation coefficients among the annual returns on stocks Tbi...View the full answer

Answered By

Deepak Sharma

0.00

0 Reviews

10+ Question Solved

Related Book For

Microsoft Excel Data Analysis And Business Modeling

ISBN: 9780137613663

7th Edition

Authors: Wayne Winston

Question Posted:

Students also viewed these Business questions

-

a. Stock market index information: S&P 500 (stock) index level: Nasdaq Composite (stock) index level: b. Interest rate information : Prime rate: Federal funds rate: Commercial paper rate (90 days):...

-

The file S03_64.xlsx lists monthly data since 1950 on the well-known Dow Jones Industrial Average (DJIA), as well as the less well-known Dow Jones Transportation Average (DJTA) and Dow Jones...

-

The file S02_35.xlsx contains data from a survey of 500 randomly selected (fictional) households. a. Create a table of correlations between the last five variables (First Income to Debt). On the...

-

The accounting records for The Skate Shed, Inc., reflected the following amounts at the end of January 2018: Prepare The Skate Shed?s multistep income statement for the fiscal year ended January 31,...

-

Service. For $50,000, they give you training and exclusive territorial rights. Equipment can be purchased through the home office for an additional $50,000, all of which will be straight-line...

-

The following evidence supports the idea that STM and LTM are two separate processes: (a) differences in the primary mode of coding, with LTM more likely than STM to be coded semantically; (b)...

-

What is meant by accounting symmetry between the entries recorded by the debtor and creditor in a troubled debt restructuring involving a modification of terms? In what ways is the accounting for...

-

Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2010, for $80,000. The machine has an estimated useful life of nine years and a residual value of $8,000. Bloomer...

-

In relation to the management of conflict, which of the following approaches will maximise the prospect of consensus? A Acceptance B Negotiation C Avoidance D Assertiveness (2 marks)

-

Hilltop Coffee manufactures a coffee product by blending three types of coffee beans. The cost per pound and the available pounds of each bean are as follows: Consumer tests with coffee products were...

-

Suppose you believe that over the next five years, stocks will produce returns that are 5 percent worse per year, on average, than the 19732012 data. Find an asset allocation among stocks, T-bills,...

-

Many mutual funds and investors hedge the risk that stocks will go down by purchasing put options. How could an asset-allocation model be used to determine an optimal hedging strategy that uses puts?

-

What is a savings account?

-

1. (5 pts) Given y[n]= 2y[n-1] and y[0]=2, Write MATLAB code to calculate and plot y for 0

-

F ( t ) = t 4 + 1 8 t 2 + 8 1 2 , g ( t ) = ( t + 3 ) / 3 ; find ( f o g ) ( 9 )

-

How did they calculate allocated cost FLIGHT A FLIGHT 350 615 FLIGHT 3 1 Go GALS 20 G EXISTING SCHEME, DETERMINE THE OVE OR FLIGHTS A, B, AND C. 2 ED AT 7.00 PER K1.00 OF PILOT SALAF TOTAL NON-SALARY...

-

High Tech ManufacturingInc., incurred total indirect manufacturing labor costs of $540,000. The company is labor-intensive. Total labor hours during the period were 5,000. Using qualitativeanalysis,...

-

Start with AS/AD and IS/MP in full employment equilibrium. Assume the is a massive positive aggregate demand shock. How would this affect AS/AD and IS/MP and prices and output relative to the full...

-

During 2017, Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business ................................................. $400,000 Business...

-

A container holds 2.0 mol of gas. The total average kinetic energy of the gas molecules in the container is equal to the kinetic energy of an 8.0 10-3-kg bullet with a speed of 770 m/s. What is the...

-

Simple exponential smoothing with = 0.3 is being used to forecast sales of SLR (single lens reflex) cameras at an appliance store. Forecasts are made on a monthly basis. After August camera sales...

-

Holts method assumes an additive trend. For example, a trend of five means that the level will increase by five units per period. Suppose that there is actually a multiplicative trend. For example,...

-

A version of simple exponential smoothing can be used to predict the outcome of sporting events. To illustrate, consider pro football. Assume for simplicity that all games are played on a neutral...

-

explain in excel please For a particular product the price per unit is $6. Calculate Revenue if sales in current period is 200 units. Conduct a data analysis, on revenue by changing the number of...

-

Hall Company sells merchandise with a one-year warranty. In the current year, sales consist of 35,000 units. It is estimated that warranty repairs will average $10 per unit sold and 30% of the...

-

Q 4- Crane Corporation, an amusement park, is considering a capital investment in a new exhibit. The exhibit would cost $ 167,270 and have an estimated useful life of 7 years. It can be sold for $...

Study smarter with the SolutionInn App