Angela Care Homes Ltd. (Angela) operates 14 care homes for people suffering with mental illness in Western

Question:

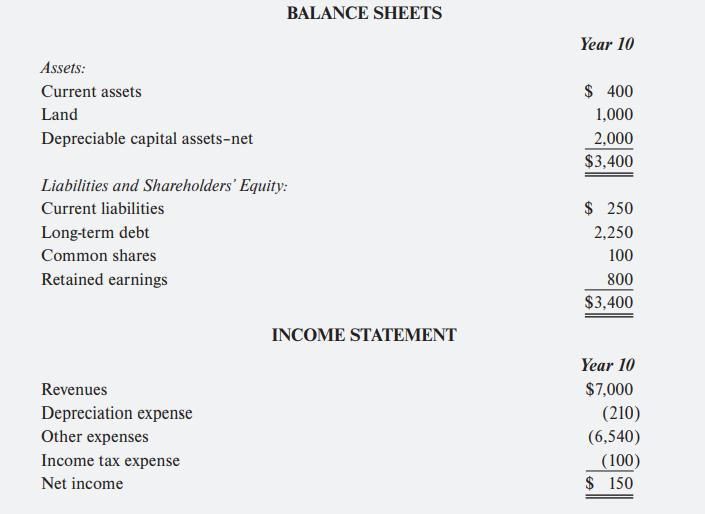

Angela Care Homes Ltd. (Angela) operates 14 care homes for people suffering with mental illness in Western Canada. It hopes to expand to Eastern Canada over the next few years and is considering going public to raise the funds for the expansion. Angela is a private Canadian company. It has been using the current taxes payable method under ASPE to account for income taxes but is considering the future income tax method, which is required under IFRS. The CEO wants to understand the impact on the current ratio, debt-to-equity ratio, and return on equity if the company changes to the future income tax method. The condensed financial statements for Angela for Year 10 under the taxes payable method are presented below (in 000s):

Additional Information

• The difference between the undepreciated capital cost for tax purposes and the carrying amount of the depreciable capital assets for accounting purposes at the end of Year 10 is a $225 taxable temporary difference which would give rise to a future tax liability of $90.

• The difference between the capital cost allowance for tax purposes and depreciation expense for accounting purposes for Year 10 is a $50 taxable temporary difference, which would give rise to a future tax expense of $20.

• Current liabilities includes $30 of unearned revenue from deposits for last month rent which were received in Year 10. The deposits are taxable when the cash is received and recognized in accounting income when the rent is earned in the last month of the lease. The difference gives rise to a $30 deductible temporary difference and a future tax recovery of $12.

• All future income tax assets and liabilities are netted against each other and presented as either a net asset or net liability and classified as noncurrent items on the balance sheet.

• The company’s tax rate is 40%.

Required

Prepare a memo to the CEO to explain and interpret the impact on the key ratios and to discuss whether the new method should be adopted.

Step by Step Answer:

Modern Advanced Accounting In Canada

ISBN: 9781260881295

10th Edition

Authors: Hilton Murray, Herauf Darrell