On January 1, Year 2, Taylor Corp. acquired 100% of the outstanding shares of Toronto Inc. for

Question:

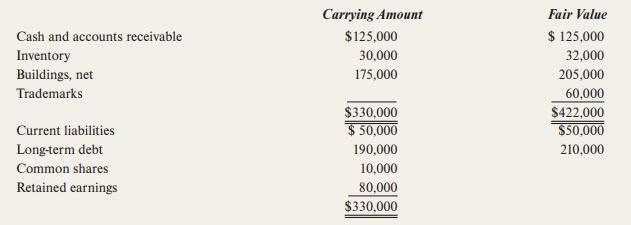

On January 1, Year 2, Taylor Corp. acquired 100% of the outstanding shares of Toronto Inc. for a total cost of $226,000. The carrying amount and fair value of Toronto’s assets and liabilities on this date were as follows:

On January 1, Year 2, the buildings and trademarks had an estimated useful life of ten and fifteen years, respectively. The long-term debt is due on December 31, Year 6. A goodwill impairment test in Year 4 indicated a value of $23,000 for Toronto’s goodwill. There were no other impairment losses.

Required

(a) Prepare a schedule of changes to the acquisition differential for each year from the date of acquisition to the end of Year 4.

(b) Now assume that Taylor had only acquired 70% of the common shares of Toronto at a cost of $147,000. Briefly explain how this would change the amounts calculated in part (a).

Step by Step Answer:

Modern Advanced Accounting In Canada

ISBN: 9781260881295

10th Edition

Authors: Hilton Murray, Herauf Darrell