Piraz Inc. owns 80% of the common shares of Shiraz Ltd. and 70% of the common shares

Question:

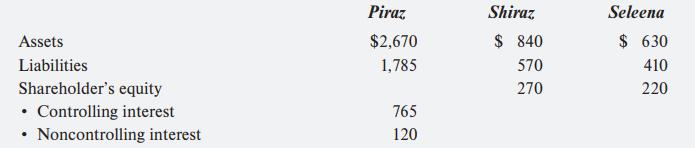

Piraz Inc. owns 80% of the common shares of Shiraz Ltd. and 70% of the common shares of Seleena Corp. Piraz has a debt covenant that imposes a maximum debt-to-equity ratio of two for its consolidated financial statements. If the covenant is not met, the $400 loan could be called.

Shiraz owns a property with an office building on it. The carrying value of the land and building is $50 and $200, respectively. The fair value of the land and building is $90 and $190, respectively. The building has an estimated remaining useful life of 10 years.

Prior to this transaction, the condensed balance sheets for the three reporting entities were as follows:

There is no undepleted acquisition differential and no unrealized profits from previous intercompany transactions.

Required

Prepare a memo to the management of Piraz to explain whether the proposed transaction will achieve their objective.

Step by Step Answer:

Modern Advanced Accounting In Canada

ISBN: 9781260881295

10th Edition

Authors: Hilton Murray, Herauf Darrell