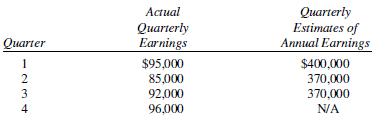

Actual quarterly earnings and quarterly estimates of annual earnings for Sloan Company for the year ended December

Question:

Actual quarterly earnings and quarterly estimates of annual earnings for Sloan Company for the year ended December 31, 2019 are as follows:

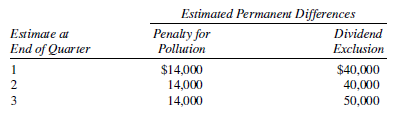

The combined state and federal tax rate for 2019 is 30%. Sloan Company estimated it would have permanent differences between accounting income and taxable income during 2019. Each quarter?s estimate of these annual differences is provided in the following table:

The actual amount of permanent differences for 2019 were environmental penalties, $14,000 dividend exclusion, $55,000.

Required:

Prepare journal entries to record Sloan Company?s 2019 quarterly income tax provisions.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: