Allison Corporation acquired all of the outstanding voting stock of Mathias, Inc., on January 1, 2023, in

Question:

Allison Corporation acquired all of the outstanding voting stock of Mathias, Inc., on January 1, 2023, in exchange for $5,875,000 in cash. Allison intends to maintain Mathias as a wholly owned subsidiary. Both companies have December 31 fiscal year-ends. At the acquisition date, Mathias’s stockholders’ equity was $2,000,000 including retained earnings of $1,500,000.

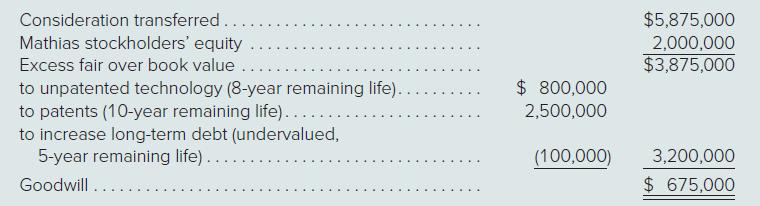

At the acquisition date, Allison prepared the following fair-value allocation schedule for its newly acquired subsidiary:

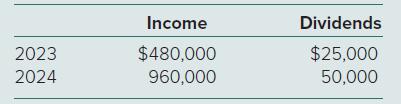

Postacquisition, Allison employs the equity method to account for its investment in Mathias. During the two years following the business combination, Mathias reports the following income and dividends:

No asset impairments have occurred since the acquisition date.

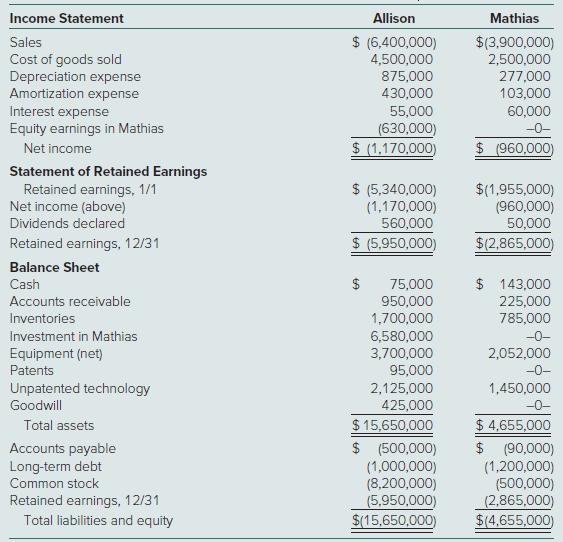

Individual financial statements for each company as of December 31, 2024, follow. Parentheses indicate credit balances. Dividends declared were paid in the same period.

Required

a. Show how Allison determined its December 31, 2024, Investment in Mathias balance.

b. Prepare a worksheet to determine the consolidated values to be reported on Allison’s financial statements.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik