As a result of its export sales to customers in Switzerland, the Lenox Company has had Swiss-franc-denominated

Question:

As a result of its export sales to customers in Switzerland, the Lenox Company has had Swiss-franc-denominated revenues over the past number of years. In order to gain protection from future exchange rate fluctuations, the company decides to borrow its current financing requirements in Swiss francs. Accordingly, on January 1, Year 1, it borrows SF1,400,000 at 12%

interest, to be repaid in full on December 31, Year 3. Interest is paid annually on December 31. The management designates this loan as a cash flow hedge of future SF revenues, which are expected to be received as follows:

Year 1 SF 560,000

Year 2 490,000

Year3 350,000

SF1,400,000

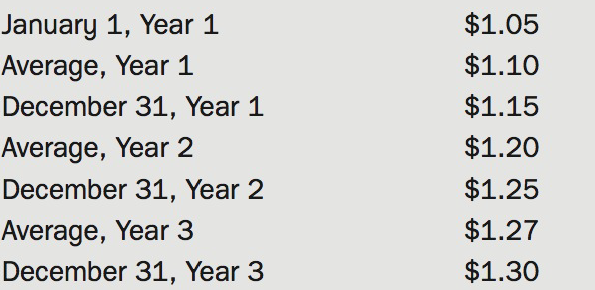

Actual revenues turned out to be exactly as expected each year and were received in cash. Exchange rates for the Swiss franc during the period were as follows:

Required:

Prepare the journal entries required each year.

Exchange RateThe value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell