Assume The Coca-Cola Company acquires all of the stock of Bubbly Bottler on January 1, 2016, at

Question:

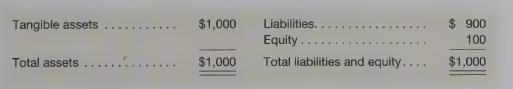

Assume The Coca-Cola Company acquires all of the stock of Bubbly Bottler on January 1, 2016, at a cost of \($950\) million in cash. Bubbly's balance sheet on that date is as follows (in millions):

Bubbly’s tangible assets and liabilities are reported at amounts approximating fair value, and the excess paid over book value is attributed entirely to goodwill.

Required

a. Assume that Coca-Cola reports its investment in Bubbly as a significant influence investment, because although it owns all of Bubbly’s stock, the decision-making structure at Bubbly does not allow Coca-Cola to control Bubbly. How does Coca-Cola record the investment at January 1, 2016?

b. Now assume that Coca-Cola controls Bubbly and reports the acquisition as a merger. How does Coca-Cola record the investment at January 1, 2016?

c. Assume Coca-Cola’s balance sheet just prior to the acquisition consists of \($80,000\) million in assets and \($20,000\) million in liabilities. Calculate Coca-Cola’s leverage, measured as total liabilities divided by total assets, if Coca-Cola reports its investment in Bubbly as a significant influence investment and as a merger.

d. Which reporting choice allows Coca-Cola to appear more financially viable? As Coca-Cola’s auditor, how do you evaluate Coca-Cola’s reporting choice?

Step by Step Answer: