Question

Tom Lamont, age 30, and Lin Lamont, age 31, have been married for six years. They got married right after Tom graduated from college. They

Tom Lamont, age 30, and Lin Lamont, age 31, have been married for six years. They got married right after Tom graduated from college. They have come to you for help in planning their financial future. They’re both employed in highly stable positions. Tom works in the marketing department of a large corporation. Lin works for a nonprofit service organization.

Instructions

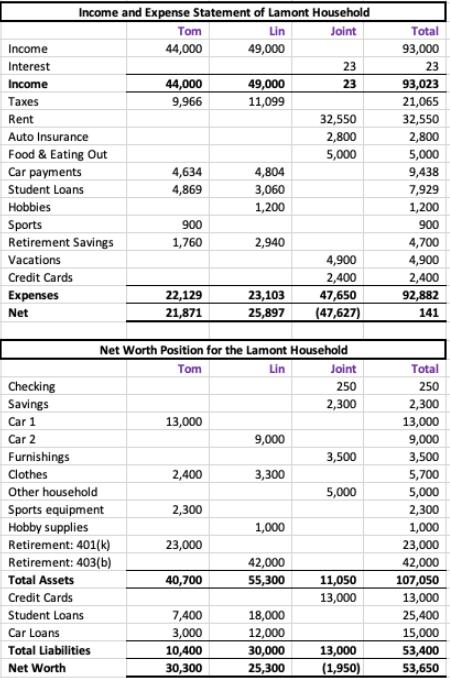

Use the following income, expense, asset, and liability information to answer Tom and Lin’s questions.

QUESTIONS:

Lin has been investigating the housing market. She found a wonderful new house priced at $205,000. Given their credit score, she is confident that she and Tom can qualify for a 30-year, fixed-rate 5.20% mortgage. If they were to purchase this home, how much of a down payment will they need to have in order to avoid PMI? How much will they need to put down if they use a 5% down payment?

Given their current financial situation, do Lin and Tom have sufficient assets to make either a 5% or 20% down payment? If they don’t have enough, what can they do?

Lin anticipates receiving a gift from her parents to help offset the expense of a down payment. If a homeowner’s insurance policy will cost $1,400 per year and property taxes will be $4,300 per year, what will be their monthly PITI on a loan with a 20% down payment? What will be the monthly PITI with a 5% down payment, assuming private mortgage insurance costs $900 per year?

Do Lin and Tom meet HUD’s housing payments to income ratio? Do they meet HUD’s total fixed payments to income ratio for either the 20% down payment scenario or the 5% down payment scenario?

Based on your estimates, do you agree or disagree with Lin that they should purchase a home, assuming they have at least a 5% down payment, at this time?

Income and Expense Statement of Lamont Household Lin Joint 49,000 Income Interest Income Taxes Rent Auto Insurance Food & Eating Out Car payments Student Loans Hobbies Sports Retirement Savings Vacations Credit Cards Expenses Net Checking Savings Car 1 Car 2 Furnishings Clothes Other household Sports equipment Hobby supplies Retirement: 401(k) Retirement: 403(b) Total Assets Credit Cards Student Loans Car Loans Total Liabilities Net Worth Tom 44,000 44,000 9,966 4,634 4,869 900 1,760 22,129 21,871 13,000 2,400 2,300 23,000 Net Worth Position for the Lamont Household Tom Lin 40,700 49,000 11,099 7,400 3,000 10,400 30,300 4,804 3,060 1,200 2,940 23,103 25,897 9,000 3,300 1,000 42,000 55,300 23 23 18,000 12,000 30,000 25,300 32,550 2,800 5,000 4,900 2,400 47,650 (47,627) Joint 250 2,300 3,500 5,000 11,050 13,000 13,000 (1,950) Total 93,000 23 93,023 21,065 32,550 2,800 5,000 9,438 7,929 1,200 900 4,700 4,900 2,400 92,882 141 Total 250 2,300 13,000 9,000 3,500 5,700 5,000 2,300 1,000 23,000 42,000 107,050 13,000 25,400 15,000 53,400 53,650

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Lin has been investigating the housing market She found a wonderful new house priced at 205000 Given their credit score she is confident that she and Tom can qualify for a 30year fixedrate 520 mortgag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started