Assuming that Brandt entered into a forward contract to sell 10 million South Korean won on December

Question:

Assuming that Brandt entered into a forward contract to sell 10 million South Korean won on December 1, 2020, as a fair value hedge of a foreign currency receivable, what is the net impact on its net income in 2020 resulting from a fluctuation in the value of the won? Brandt amortizes forward points on a monthly basis using a straight-line method. Ignore present values.

a. No impact on net income

b. $100 decrease in net income

c. $250 decrease in net income

d. $2,000 increase in net income

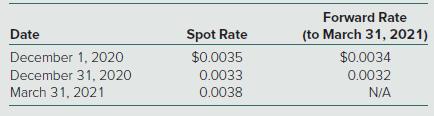

Brandt Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2020, with

payment of 10 million South Korean won to be received on March 31, 2021. The following exchange

rates apply:

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik