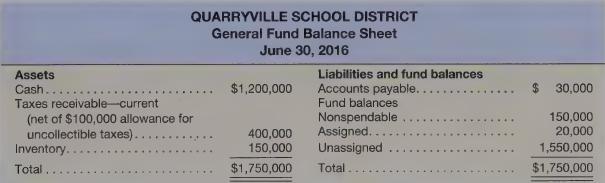

Data relating to the general fund of the Quarryville School District are: Additional information for fiscal 2017:

Question:

Data relating to the general fund of the Quarryville School District are:

Additional information for fiscal 2017:

1. The fiscal 2017 budget included \($3,200,000\) in expected revenue, all from property taxes, estimated other financing uses of \($200,000,\) and appropriations of \($3,100,000.\) The tax levy was for \($3,800,000.\)

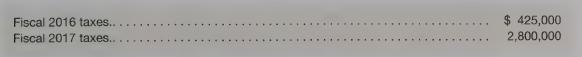

2. Tax collections during fiscal 2017 were as follows:

3. Taxes due at year-end are not considered delinquent but are 20-percent reserved. Unpaid 2016 taxes are written off as uncollectible.

4. Old school desks were sold for \($10,000\) in cash.

5. New desks were purchased for \($500,000\) in cash.

6. Vandalism to the schools resulted in \($20,000\) of unexpected repair and cleanup costs, paid in cash.

7. Salary expenditures by the general fund were \($2,500,000\) in cash.

8. Supplies on hand at year-end totaled \($125,000,\) per annual physical inventory. Quarryville uses the consumption method.

9. Accounts payable of \($25,000\) were outstanding at the end of fiscal 2017, and \($50,000\) was encumbered for goods ordered but not yet received. The GAAP budgetary basis is used.

10. The 2016 encumbrance for \($20,000\) was canceled. when the goods ordered were found to be defective.

11. Cash of \($80,000\) was paid to the enterprise fund, as the school district’s support for its operating costs.

Required

a. Prepare all the fiscal 2017 journal entries and closing entries for the school district’s general fund.

b. Prepare a fiscal 2017 statement of revenues, expenditures, and changes in fund balances and balance sheet for the general fund.

Step by Step Answer: