The Wayne City Council approved and adopted its general fund budget for 2016. The budget contained the

Question:

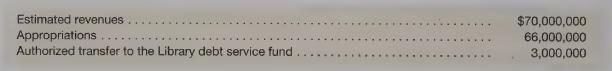

The Wayne City Council approved and adopted its general fund budget for 2016. The budget contained the following amounts:

During 2016, various transactions and events occurred which affected the general fund. The legal budgetary basis is used.

Required

For items 1—39, indicate whether the item should be debited (D), credited (C), or is not affected (N) in the general fund.

a. Items 1-5 involve recording the adopted budget

1. Estimated revenues

2. Fund balance—unassigned

3. Appropriations

4. Estimated other financing uses

5. Expenditures

b. Items 6-10 involve recording the 2016 property tax levy. It was estimated that \($500,000\) would be uncollectible.

6. Property taxes receivable—current

7. Bad debt expense

8. Allowance for uncollectibles—current

9. Revenues

10. Estimated revenues

c. Items 11-15 involve recording encumbrances at the time purchase orders are issued.

11. Encumbrances

12. Fund balance—assigned

13. Expenditures

14. Accounts payable

15. Purchases

d. Items 16-20 involve recording expenditures that had been previously encumbered in the current year.

16. Encumbrances

17. Fund balance —assigned

18. Expenditures

19. Accounts payable

20. Purchases

e. Items 21-25 involve recording the transfer made to the Library debt service fund. No previous entries were made regarding this transaction.

21. Fund balance —assigned

22. Due from Library debt service fund

23. Cash

24. Other financing uses

25. Encumbrances

f. Items 26-36 involve recording the closing entries (other than encumbrances) for 2016.

26. Estimated revenues

27. Due to special revenue fund

28. Appropriations

29. Estimated other financing uses

30. Expenditures

31. Revenues

32. Other financing uses

33. Bonds payable

34. Bad debt expense

35. Depreciation expense

36. Fund balance—assigned

g. Items 37-39 involve recording the closing entry related to \($1,200,000\) of outstanding encumbrances at the end of 2016.

37. Encumbrances

38. Fund balance—assigned

39. Fund balance—unassigned

Step by Step Answer: