Day and Night formed an accounting partnership in 2019. Capital transactions for Day and Night during 2019

Question:

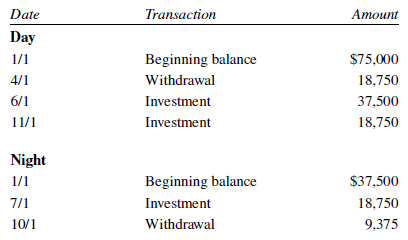

Day and Night formed an accounting partnership in 2019. Capital transactions for Day and Night during 2019 are as follows:

Partnership net income for the year ended December 31, 2019; is $68,400 before considering salaries or interest.

Required:

Determine the amount of profit that is to be allocated to Day and Night in accordance with each of the following independent profit-sharing agreements:

1. Day and Night failed to provide a profit-sharing arrangement in the articles of partnership and fail to compromise on an agreement.

2. Net income is to be allocated 60% to Day and 40% to Night.

3. Net income is to be allocated in the ratio of ending capital balances.

4. Net income is to be allocated in the ratio of average capital balances.

5. Interest of 15% is to be granted on average capital balances, salaries of $15,000 and $8,250 are to be allocated to Day and Night, respectively, and the remainder is to be divided equally.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer: