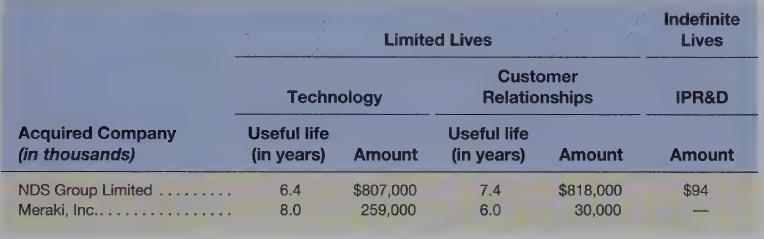

During the year ended July 27, 2013, Cisco Systems, Inc. acquired the following identifiable intangible assets through

Question:

During the year ended July 27, 2013, Cisco Systems, Inc. acquired the following identifiable intangible assets through its purchase of two companies:

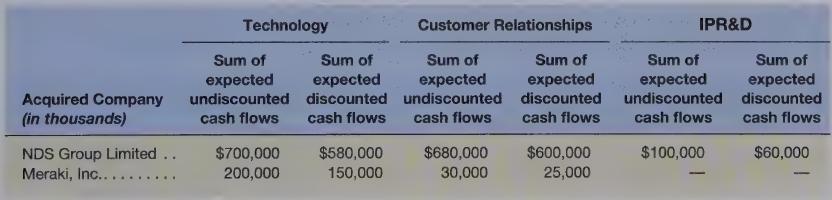

Cisco acquired NDS Group at the beginning of fiscal 2013, and Meraki, Inc. at the end of the second quarter of fiscal 2013. Assume that Cisco separately tests identifiable intangibles acquired from each company for impairment, and collects the following information to conduct impairment tests at the end of fiscal 2013:

Round your answers below to the nearest thousand.

Required

a. Calculate amortization expense for the above identifiable intangibles for fiscal 2013. Intangibles are amortized on a straight-line basis starting in the month following acquisition.

b. Calculate impairment losses for fiscal 2013.

c. Determine the amounts reported on Cisco’s fiscal 2013 balance sheet for technology, customer relationships, and in-process R&D.

Step by Step Answer: