When Parson Company acquired all of Soaper Companys stock on July 1, 2016, Soapers inventory was undervalued

Question:

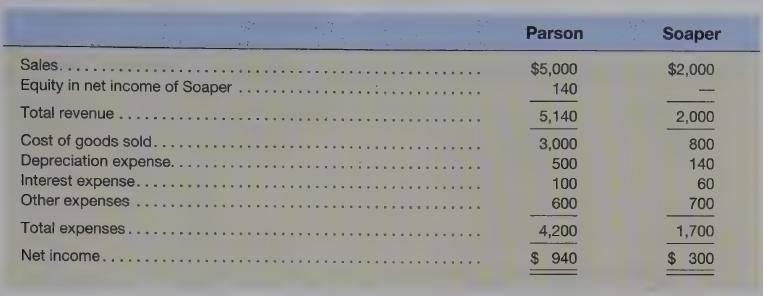

When Parson Company acquired all of Soaper Company’s stock on July 1, 2016, Soaper’s inventory was undervalued by \($160,000,000\), plant assets with a 10-year life were overvalued by \($200,000,000\), and long-term debt which matures in five years was overvalued by \($100,000,000\). No goodwill arose in the combination. All of Soaper’s depreciation and amortization charges are based on the straight-line method. The undervalued inventory was sold during the year ended June 30, 2017. The separate income statements of Parson and Soaper for the year ended June 30, 2017, follow (amounts in millions).

Required

a. Prepare a consolidated income statement for Parson and Soaper for the year ended June 30, 2017.

b. Why is consolidated income the same as Parson's separately reported net income?

Step by Step Answer: