International Foods, a U.S. company, acquired two companies in 2016. As a result, its consolidated financial statements

Question:

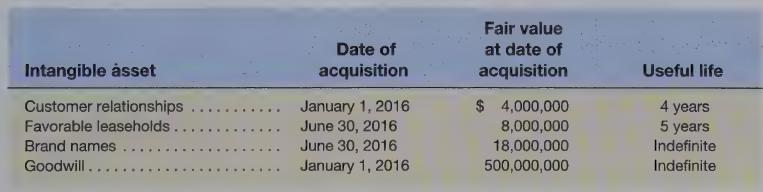

International Foods, a U.S. company, acquired two companies in 2016. As a result, its consolidated financial statements include the following acquired intangibles:

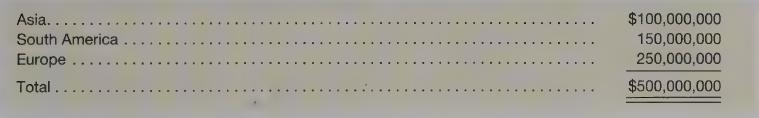

Goodwill was assigned to the following reporting units:

It is now December 31, 2017, the end of International Foods’ accounting year. No impairment losses were reported on any intangibles in 2016. Assume that International Foods bypasses the qualitative option for impairment testing of goodwill and indefinite life intangibles.

Required

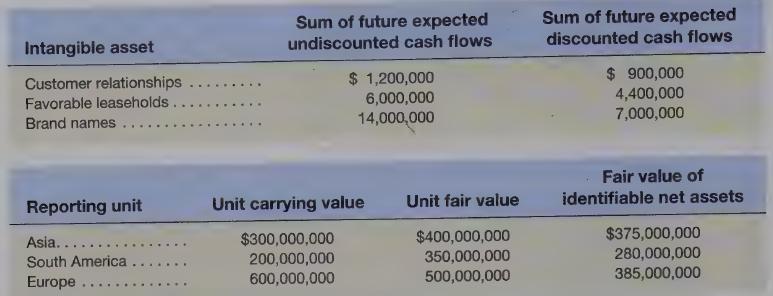

Compute 2017 amortization expense and impairment losses on the above intangibles, following U.S.

GAAP.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: