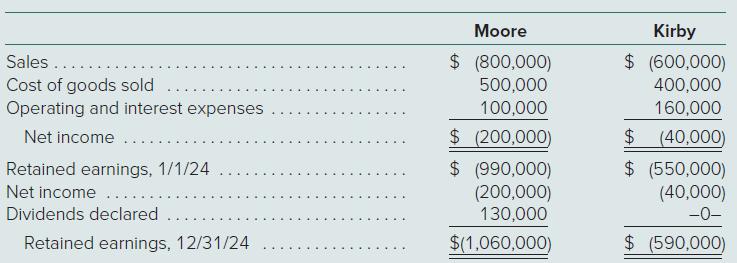

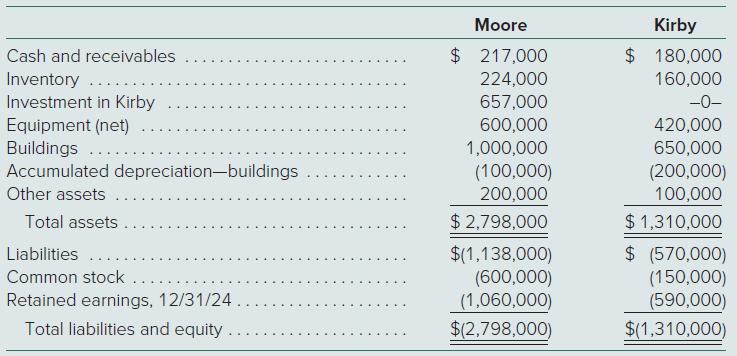

Following are financial statements for Moore Company and Kirby Company for 2024: Moore purchased 90 percent

Question:

Following are financial statements for Moore Company and Kirby Company for 2024:

∙ Moore purchased 90 percent of Kirby on January 1, 2023, for $657,000 in cash. On that date, the 10 percent noncontrolling interest was assessed to have a $73,000 fair value. Also at the acquisition date, Kirby held equipment (4-year remaining life) undervalued in its financial records by $20,000 and interest-bearing liabilities (5-year remaining life) overvalued by $40,000. The rest of the excess fair over book value was assigned to previously unrecognized brand names and amortized over a 10-year life.

∙ During 2023, Kirby reported a net income of $80,000 and declared no dividends.

∙ Each year, Kirby sells Moore inventory at a 20 percent gross profit rate. Intra-entity sales were $145,000 in 2023 and $160,000 in 2024. On January 1, 2024, 30 percent of the 2023 transfers were still on hand, and on December 31, 2024, 40 percent of the 2024 transfers remained.

∙ Moore sold Kirby a building on January 2, 2023. It had cost Moore $100,000 but had $90,000 in accumulated depreciation at the time of this transfer. The price was $25,000 in cash. At that time, the building had a five-year remaining life.

Determine all consolidated balances either computationally or by using a worksheet.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik