On January 1, 2023, Pulaski, Inc., acquired a 60 percent interest in the common stock of Sheridan,

Question:

On January 1, 2023, Pulaski, Inc., acquired a 60 percent interest in the common stock of Sheridan, Inc., for $372,000. Sheridan’s book value on that date consisted of common stock of $100,000 and retained earnings of $220,000. Also, the acquisition-date fair value of the 40 percent noncontrolling interest was $248,000. The subsidiary held patents (with a 10-year remaining life) that were undervalued within the company’s accounting records by $70,000 and also had unpatented technology (15-year estimated remaining life) undervalued by $45,000. Any remaining excess acquisition-date fair value was assigned to an indefinite-lived trade name. Since acquisition, Pulaski has applied the equity method to its Investment in Sheridan account. At year-end, there are no intra-entity payables or receivables.

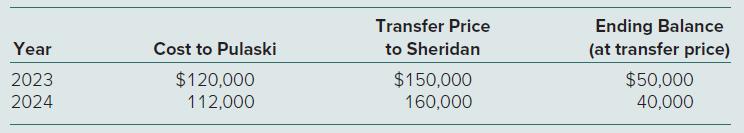

Intra-entity inventory sales between the two companies have been made as follows:

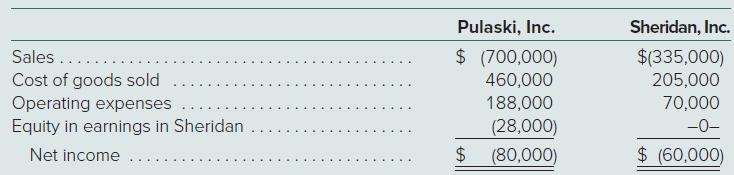

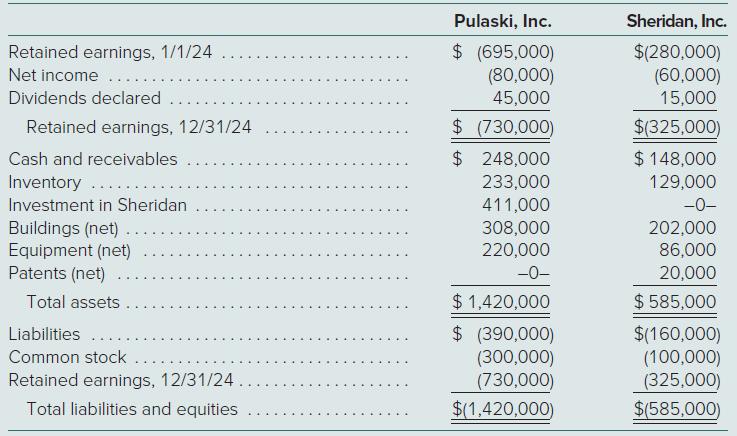

The individual financial statements for these two companies as of December 31, 2024, and the year then ended follow:

a. Show how Pulaski determined the $411,000 Investment in Sheridan account balance. Assume that Pulaski defers 100 percent of downstream intra-entity profits against its share of Sheridan’s income.

b. Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December 31, 2024.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik