Following IFRS, Nokia Corporation allocates its goodwill to the cash-generating units that benefit from the business combinations

Question:

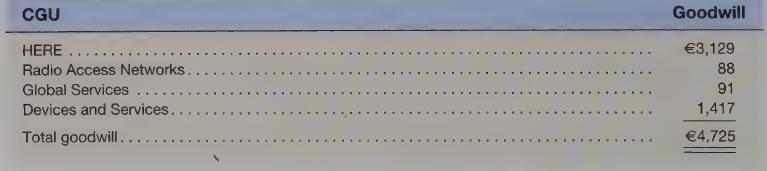

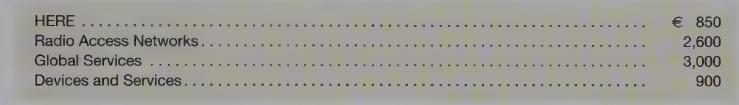

Following IFRS, Nokia Corporation allocates its goodwill to the cash-generating units that benefit from the business combinations generating the goodwill. In its 2013 Form 20-F, filed with the SEC, Nokia discloses the CGUs and the goodwill allocated to each (in millions):

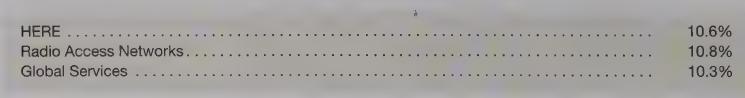

Nokia uses value-in-use to measure the fair values of HERE, Radio Access Networks, and Global Services, measured using discounted cash flows. Discount rates used in 2013 were as follows:

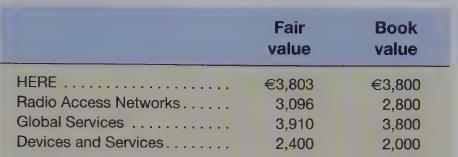

Nokia plans to sell the Devices and Services unit, and measures its fair value for goodwill impairment testing purposes at the agreed purchase price less estimated disposal costs.

Here is end-of-2013 information on Nokia’s CGUs (in millions). Book values and the fair value of the Devices and Services unit are assumed.

In your answers below, show all amounts in millions.

Required

a. Following IFRS, how is the “fair value” of a CGU defined? Does Nokia follow IFRS in measuring the fair value of its CGUs? Explain.

b. Why do you think the discount rates used for the three CGUs are different? Why is there no discount rate for the Devices and Services CGU?

c. Calculate Nokia’s goodwill impairment loss for 2013.

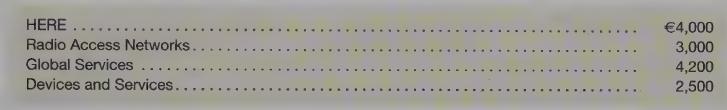

d. What if the CGU book values were as follows (in millions):

Calculate Nokia’s goodwill impairment loss for 2013, per IFRS.

e. Now assume the same book values as in d., and Nokia follows U.S. GAAP, reporting units are the same as CGUs, and Step 0 is bypassed. Assumed information on the fair values of identifiable net assets at the end of 2013 is (in millions):

Calculate Nokia’s goodwill impairment loss for 2013, per U.S. GAAP.

Step by Step Answer: