On January 1,2015, Peerless Network acquired all of the stock of Sound Telecom for ($400) million in

Question:

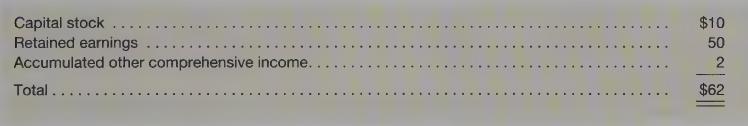

On January 1,2015, Peerless Network acquired all of the stock of Sound Telecom for \($400\) million in cash. At the date of acquisition, Sound Telecom’s stockholders’ equity was as follows (in millions):

An evaluation of Sound Telecom’s balance sheet at January 1, 2015, revealed that its plant assets (10-year remaining life) were overvalued by \($40\) million and it had previously unrecorded identifiable intangible assets (5-year remaining life) of \($10\) million. Goodwill from this acquisition was impaired by \($5\) million during 2015-2017, and by \($1\) million in 2018.

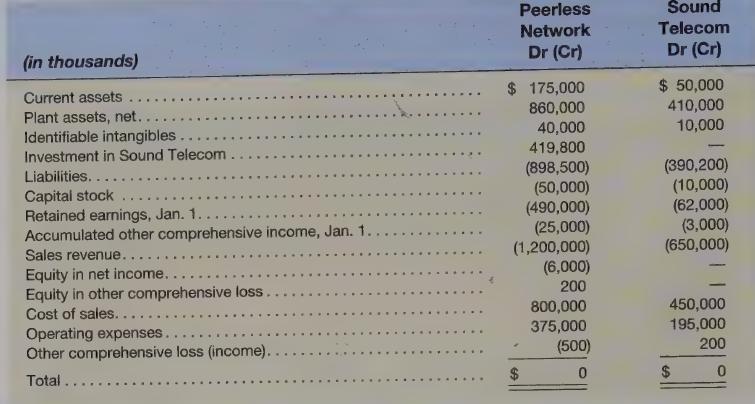

It is now December 31, 2018, four years after the acquisition. Sound Telecom reported total net income of \($12\) million during 201542017, and \($5\) million for 2018. It also reported total other comprehensive income of \($1\) million during 2015-2017, and \($200,000\) of other comprehensive loss in 2018. Sound Telecom declared and paid no dividends during this time period. Peerless Network reports its investment using the complete equity method. The following are the separate trial balances of Peerless and Sound Telecom at December 31, 2018.

In your answers below, show all numbers in thousands.

Required

a. Show how the following balances, appearing in the 2018 trial balances above, were calculated:

(1) Equity in net income of Sound Telecom, appearing in Peerless Network’s 2018 trial balance.

(2) Sound Telecom’s retained earnings and AOCI balances at January 1, 2018.

(3) Investment in Sound Telecom at December 31, 2018, appearing in Peerless Network’s trial balance.

b. Prepare the consolidation working paper to consolidate Peerless Network’s trial balance accounts with those of Sound Telecom at December 31, 2018.:

c. Present the consolidated balance sheet at December 31, 2018, and the consolidated statement of comprehensive income for 2018, in good form.

Step by Step Answer: