For the items listed in Exhibit 1.1, for which items would the debt-to-equity ratio not change when

Question:

For the items listed in Exhibit 1.1, for which items would the debt-to-equity ratio not change when a company switched from ASPE to IFRS?

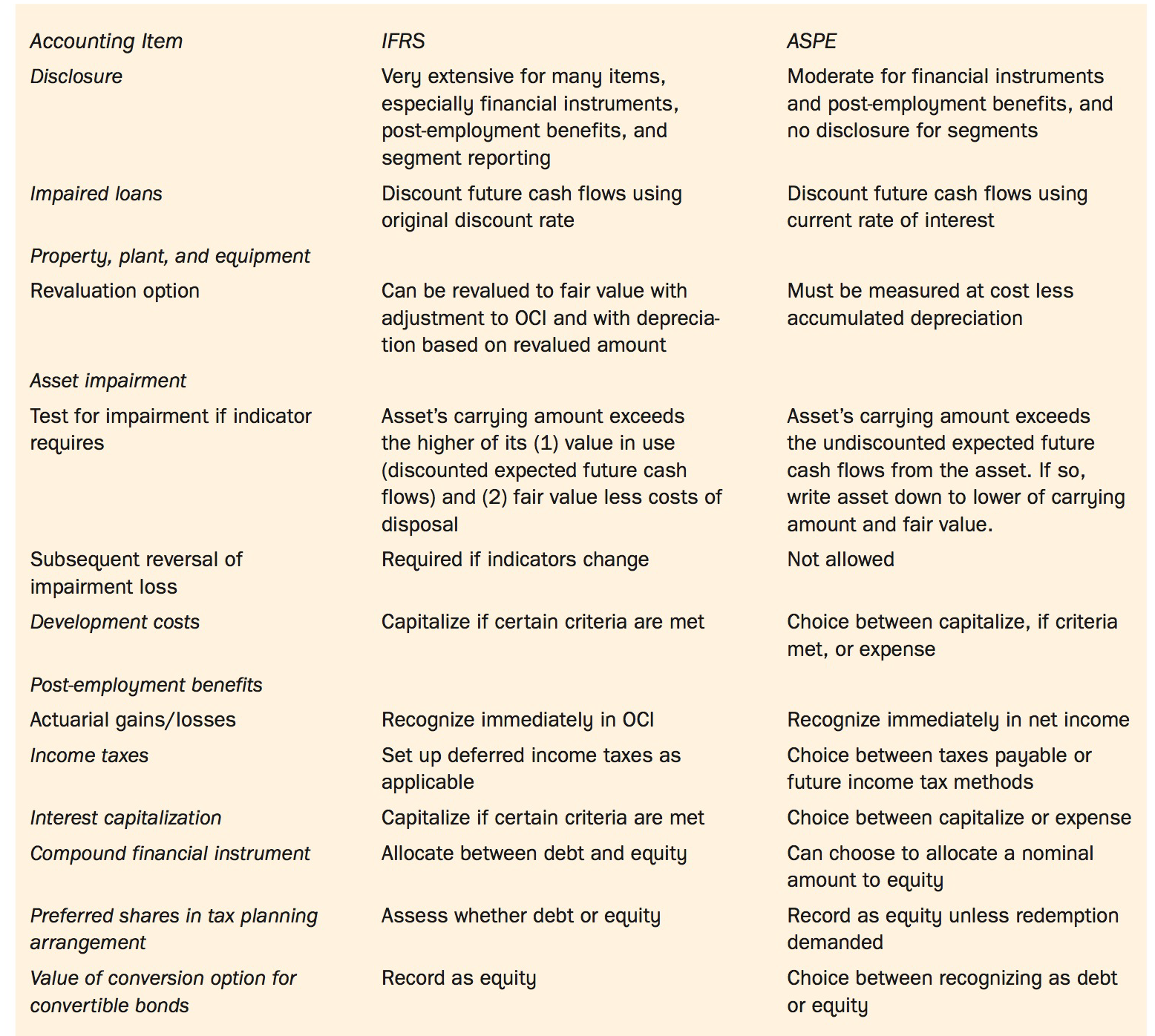

Exhibit 1.1:

Some key different between IFRS and ASPE

Accounting Item IFRS ASPE Very extensive for many items, especially financial instruments, post-employment benefits, and segment reporting Disclosure Moderate for financial instruments and post-employment benefits, and no disclosure for segments Discount future cash flows using Discount future cash flows using Impaired loans original discount rate current rate of interest Property, plant, and equipment Revaluation option Can be revalued to fair value with Must be measured at cost less adjustment to OCI and with deprecia- accumulated depreciation tion based on revalued amount Asset impairment Asset's carrying amount exceeds the higher of its (1) value in use (discounted expected future cash flows) and (2) fair value less costs of Test for impairment if indicator requires Asset's carrying amount exceeds the undiscounted expected future cash flows from the asset. If so, write asset down to lower of carrying disposal amount and fair value. Subsequent reversal of impairment loss Required if indicators change Not allowed Capitalize if certain criteria are met Development costs Choice between capitalize, if criteria met, or expense Post-employment benefits Actuarial gains/losses Recognize immediately in OCI Recognize immediately in net income Choice between taxes payable or Set up deferred income taxes as applicable Income taxes future income tax methods Choice between capitalize or expense Interest capitalization Capitalize if certain criteria are met Allocate between debt and equity Compound financial instrument Can choose to allocate a nominal amount to equity Preferred shares in tax planning Assess whether debt or equity Record as equity unless redemption demanded arrangement Record as equity Choice between recognizing as debt Value of conversion option for or equity convertible bonds

Step by Step Answer:

For the item listed in Ex...View the full answer

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Identify the main factors to be used when ranking the importance of issues to be resolved.

-

In June 2018, the government of Vartan invited bids for the construction of a cellular telephone network. Zen Tel, an experienced communications company, was eager to enter the growing field of...

-

Hofstra Plastics lnc.'s selected data for the month of August 2019 are presented below (in millions): Work-in-process inventory, August 1, 2019 S 200 Direct materials inventory, August 1, 2019 90...

-

The city pool loses 1.0 inch of water every week due to evaporation. If the pool is 25 yards long and 12 yards wide, what is the energy required to keep the pool at 15C. If the cost of energy is...

-

In each of the following find the real number(s) x for which the equation is valid. (a) 53x2 = 55x+2 (b) 4x-1 = (1/2)4x-1

-

In the left figure of Example 5, change the 2 to 6. What other changes must then be made? Data from Example 5 -4 2>-4 2 is to the right of -4 -2 0 3 <6 3 is to the left of 6 2 4 6 5 <9 0>-4 -3>-7...

-

(b) Show that there is a function such that as x ---; a, If(x)1 ---; ILl but the limit of f(x) does not exist. [!]. This exercise is used in Sections 3.2 and 5.2.

-

You are told the column totals in a trial balance are not equal. After careful analysis, you discover only one error. Specifically, a correctly journalized credit purchase of an automobile for...

-

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayer did NOT receive, sell, send, exchange, or...

-

Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1:...

-

Describe the five-step decision-making process.

-

Identify the financial statement ratios typically used to assess profitability, liquidity and solvency, respectively.

-

Jeung Hong, a widower, died in March 2020. His gross estate was $14.5 million and, at the time of his death, he owed debts of $60,000. His will made a bequest of $200,000 to his undergraduate alma...

-

Which industries gain and which industries lose from the availability of cheap natural gas produced from shale deposits? Joseph Schumpeter, an Austrian-born economist who emigrated to the United...

-

Did the value of the Canadian dollar rise or fall between Tuesday and Wednesday?

-

As vice president for community relations, you want to explore the possibility of developing service learning programs with several nearby colleges and universities. Using Figure 2.5, suggest the...

-

Your organization initiated a project to raise money for an important charity. Assume that there are 1,000 people in your organization. Also, assume that you have six months to raise as much money as...

-

A \(20-\mathrm{cm}\)-long rod, with uniform linear charge density \(100 \mathrm{nC} / \mathrm{cm}\), is set up symmetrically on the \(x\) axis. What are the magnitude and direction of the electric...

-

Assume you are in the 35 percent tax bracket and purchase a municipal bond with a yield of 3.20 percent. Use the formula presented in this chapter to calculate the taxable equivalent yield for this...

-

What are the two methods used to translate financial statements and how does the functional currency play a role in determining which method is used?

-

Briefly describe the disclosure requirements related to an investment in an associated company.

-

Which of the reporting methods described in this chapter would typically report the highest current ratio? Briefly explain.

-

How should a private company that has opted to follow ASPE report an investment in an associate?

-

Explain: An office building is renting for $10/sf, with 50,000 total leasable square feet. Office buildings in the area are selling for cap rates of 5.5%. What information do you have and what are...

-

Practicum Co. pad $1.2 million for an 80% interest in the common stock of Sarong Co. Practicum had no previous equity interest in Sarong. On the acquisition date, Sarong's identifiable net assets had...

-

On Dec 31 2020, Bernice Melson, a partner in ABC Communications, had an ending capital balance of $49,000. Her share of the partnership's profit was $18,000; she made investments of $12,000 and had...

Study smarter with the SolutionInn App